Display that it:

- Simply click so you can email a link to a pal (Reveals during the the latest windows)

- Simply click to generally share on LinkedIn (Reveals in the this new window)

Freeze Lender was actually out of the home-based home loan business to possess two decades when Chairman and President Phil Eco-friendly advised their leaders group the amount of time is actually straight to get back in.

However, he wished it complete the latest Frost way, said Bobby Berman, group exec vp regarding research and you will strategy, who was assigned that have building a home loan service on soil right up.

Today, almost 24 months immediately after proclaiming the financial would provide household financing once more, that the newest department was ninety anyone solid and has just began rolling away three home loan items in San Antonio.

Rather, filled with precisely what the bank phone calls their Progress mortgage, which supplies accredited straight down-income customers the opportunity to financing 100% of your cost of their property, doesn’t require individual financial insurance and you will covers up to help you $cuatro,000 in closing costs.

Among the first grounds we arrive at bring mortgage loans again is since i know you will find a gap in circumstances having lower-income men and women, said Berman, which registered Frost inside 1985. The bank at some point have a tendency to grow its mortgage choices to all eight Colorado places in which it does company.

The latest Progress financing aims at Bexar Condition borrowers exactly who build doing $67,two hundred, told you a lender spokesman, predicated on city average income once the determined by Federal Monetary Establishments Test Council, an agency out of lender regulators. For the Sep, one to money limit, which is adjusted a-year, will grow so you can $71,280.

You to definitely home loan could be appealing to a number of people. Median household earnings within the Bexar State is merely more than $62,000, predicated on investigation out-of Workforce Choices Alamo; over around three-household away from regional property have annual earnings lower than $100,000.

The new Progress home loan with techniques encapsulates the newest Freeze ways you to Green tried, and eschews new commodification regarding mortgage items that helped force the brand new bank from the sector to begin with.

Relational banking’

Freeze has long been concerned about creating tough buyers relationship that has provided the bank to its consistently large buyers retention score. For example, the financial institution operates an effective 24/7 hotline responded of the a frost banker, who can address customers’ questions about its account, and enable them to discover membership thereby applying getting financing.

Financial people can make the most of that brighten, just like the Freeze will not be bundling and you may attempting to sell their mortgage loans, as well as normal, and you may alternatively usually provider them to the lifetime of the mortgage, Frost authorities said. On top of that, the bank said it picked not to pay home mortgage advisors income with the money they originate to quit undertaking a reward to own them to push highest loan quantity.

Frost lso are-comes into the loan financing team from the a hard time for the majority borrowers. Interest levels has just flower on their large levels since the 2002, additionally the supply of existing property remains tight just like the people that have lowest home loan prices remain place. This new refinancing organization even offers just about disappeared due to the fact rates provides risen.

Consequently, of several large banking companies keeps let go group within their financial divisions, as well as USAA, Wells Fargo and you will Citi, completing a pool away from talent getting Frost to pick from given that occupied the mortgage service ranking.

There were enough a beneficial somebody around told you Berman, who wish to get on the floor floors at your workplace to possess a cool company that cares about the some one.

Loan regularity have went on to refuse, centered on a keen August survey because of the Federal loans Briggsdale CO Set-aside Lender of Dallas, and that listed one lenders mentality remained pessimistic.

The fresh new San Antonio Panel off Realtors stated an effective six% in July declaration, and an average rates that dipped 2% seasons more seasons. Home invested normally 57 months in the market, a good 104% boost on the earlier year.

Nice extension

Berman recognized brand new fascinating spot home credit is now into the, and you may said Freeze will focus very first into the their entire huge newest clientele. It folded out their financial circumstances first to help you personnel, then to help you the Dallas metropolitan areas inside June. San Antonio branches were stored which have informational content just a week ago.

The bank is also amid a substantial extension. This has started 29 the fresh metropolitan areas in the Houston area and you may is on song to incorporate four way more, try midway as a result of including 28 this new twigs about Dallas part and you will established the original off 17 structured the new twigs from inside the Austin the 2009 12 months. It already provides the premier Automatic teller machine network regarding the state.

A subsidiary regarding San Antonio-built Cullen/Freeze Bankers Inc., Frost Lender ‘s the largest regional financial institution based in San Antonio, having twenty-seven twigs here and you will intentions to unlock a special area from inside the Vent San Antonio towards city’s South side. As of Summer, they got $forty-eight.6 million in the property and you may kept $17.six million for the financing.

Freeze Bank had out of the home credit organization inside 2000; during the time, Environmentally friendly said that of many circumstances starred towards choice, together with that all people shopped getting mortgages predicated on rates rather than to the existing banking matchmaking, a lot of time a priority on the bank.

Are from the financial providers meant Frost Lender skirted this new bad of the subprime mortgage meltdown inside the 2007 and you will 2008. It had been the first bank, and another regarding never assume all, one to turned down federal bailout financing.

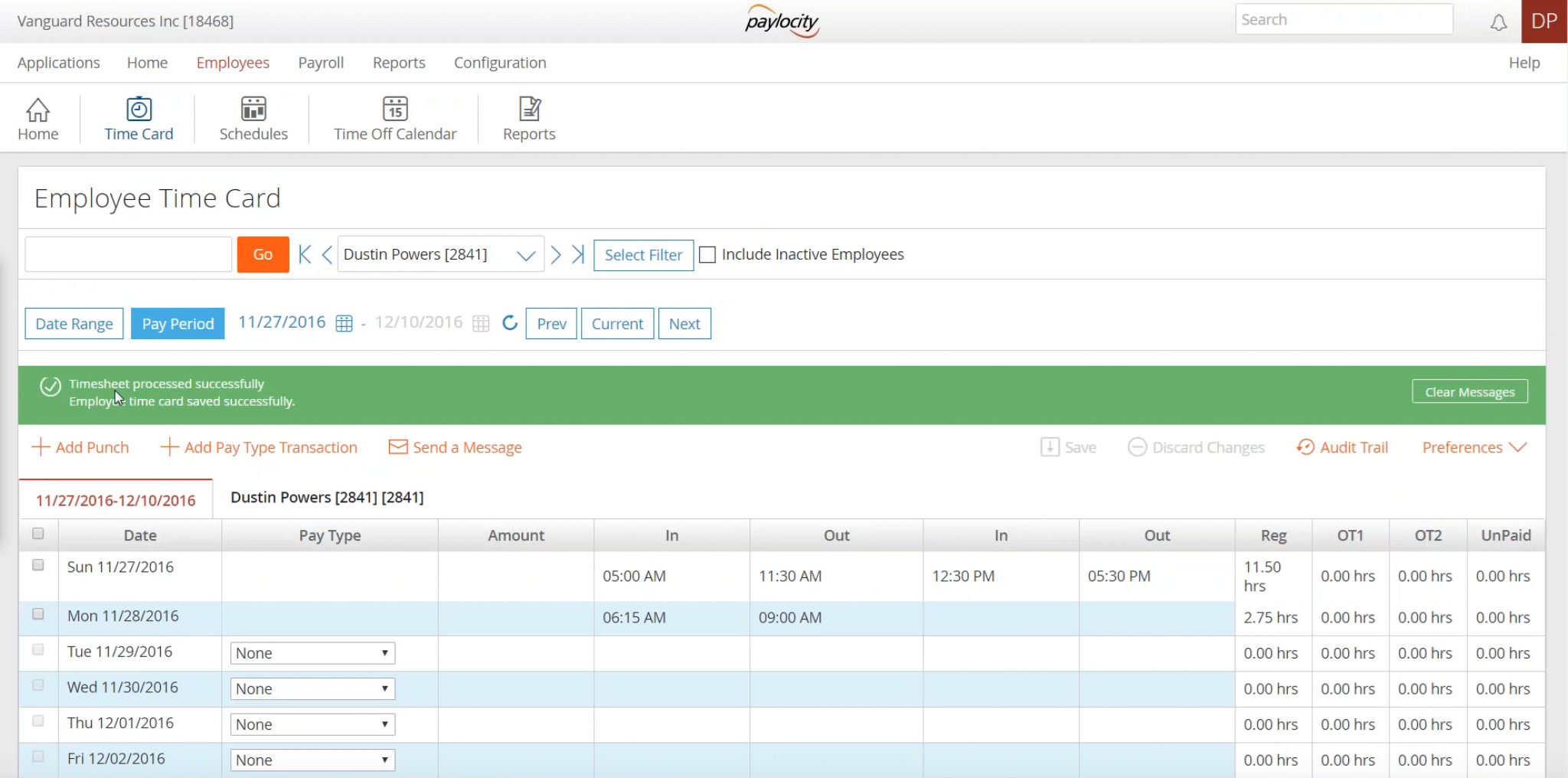

Consumers ended up being asking for mortgage loans for a while, Berman told you, and Green felt like electronic tech was also into the a location who does allow it to be Freeze to produce mortgage items that aimed which have the business’s work with relationships banking. Customers is properly over programs, publish photos away from data and signal digitally with the dotted range, and will have an employee to walk candidates thanks to all of the step of one’s techniques.

Outside the customer-centric perks, I including plan on with very aggressive, otherwise an educated, rates. In addition to lower costs, told you Berman.

That it facts might have been current to improve you to Frost Bank get the town median income analysis for its Improvements financial on Federal Financial institutions Examination Council.

Freeze Lender is actually a financial recommend of your San Antonio Statement. For an entire list of providers users, click.