Unless you run a finance-based business, accessing their financial statements is not possible for you. Yet, with the calculation of average collection period, you can predict and understand their creditworthiness. You can tune your collection periods accordingly and align accounts receivables in order. It means that your clients take a shorter period of time to pay their bills and you have less uncertainty about payment times.

Track Payment Patterns

By understanding the factors influencing this metric and implementing best practices, companies can improve their collections efficiency and enhance their overall financial position. Average collection period refers to the amount of time it takes for a business to receive payments owed by its clients in terms of accounts receivable (AR). Companies use the average collection period to make sure they have enough cash on hand to meet their financial obligations.

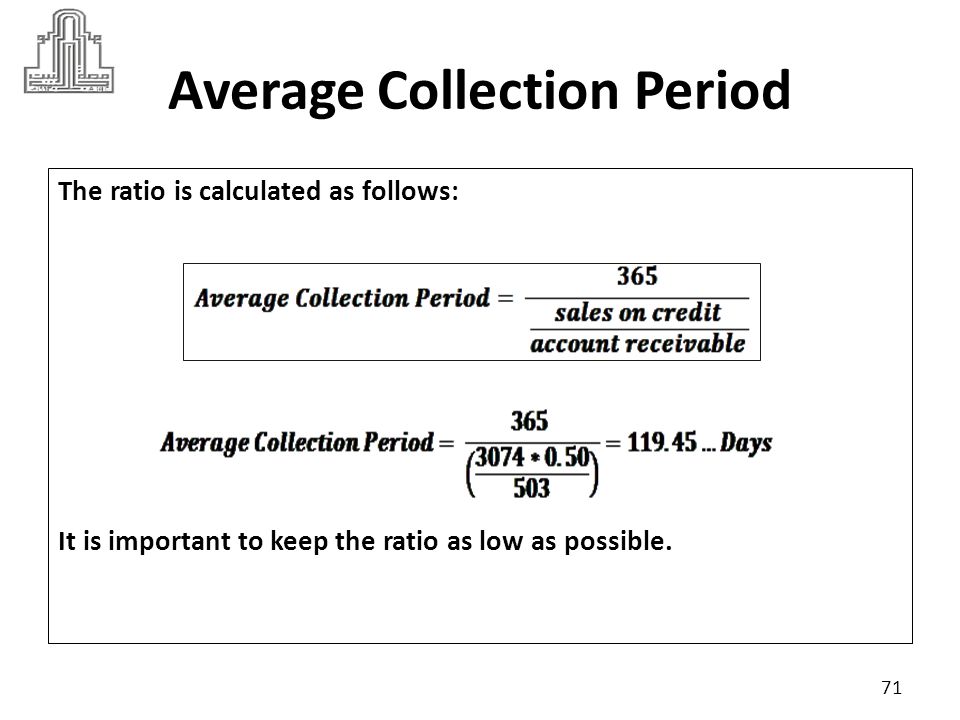

Step 3: Calculate the Average Collection Period

- By understanding the factors influencing this metric and implementing best practices, companies can improve their collections efficiency and enhance their overall financial position.

- Thus, by neglecting their policies for managing accounts receivable, they can potentially have a severe financial deficit.

- Fashion retailers, in particular, tend to have shorter collection periods due to the seasonal nature of their products and high turnover rates.

- The direct relationship between average collection period and cash flow is straightforward.

If the company is unable to continuously invest the collected funds efficiently, this surplus cash simply sitting idle could represent a cost. As money loses value over time due to inflation, the idle cash might steadily lose its purchasing power. This could potentially result in more restrictive credit terms from suppliers, higher interest rates on loans, and a lower credit rating, further impacting the financial position of the company. For example, you could offer a small discount to customers who pay their bills within a certain period.

Calculating Average Collection Period

Let us now do the top excel inventory templates analysis calculation example above in Excel. For example, if a company has a collection period of 40 days, it should provide days. Since the company needs to decide how much credit term it should provide, it needs to know its collection period. We will take a practical example to illustrate the average collection period for receivables. We’ll show you how to analyse your average collection period a little later on in this post. This way, you’ll get more nuanced, actionable insights that can fuel business growth.

Since Mosaic offers an out of the box billings and collections template, you can automatically surface outstanding invoices by due date highlighting exactly where to focus your collection efforts. As many professional service businesses are aware, economic trends play a role in your collection period. Seasonal fluctuations impact payment behaviors, which in turn affect your average collection period.

When you log in to Versapay, you get a clear dashboard of the current status of all your receivables. Your entire team can access your customers’ entire payment history, giving you a clear picture of your collection efforts. To calculate your total net credit sales, take your total sales made on credit for a given period and subtract any returns and sales allowances. Using those hypotheticals, we can now calculate the average collection period by dividing A/ R by the net credit deals in the matching period and multiplying by 365 days.

When evaluating your ACP, you want to look at how it stacks up to your credit terms and when you’re actually collecting payment. Generally, you want to keep your average collection period or DSO under 45 days; however, this number can vary by industry. It’s vital that your accounts receivable team closely monitor this metric and keep it as low as possible. We’ll discuss how to find your average collection period and analyze it further in this article. That’s why it’s important not to take this metric at face value; be mindful of external factors that influence it.

The faster the turnover, the shorter the collection period, which indicates efficient credit sales management. Industry comparisons can also reveal how credit terms impact collections performance. Companies with shorter credit terms and quicker payment cycles may benefit from reduced DSO and improved cash flow.

It indicates that a company’s clients pay their bills faster, or that the company collects payments faster. Instead of carrying out your collections processes manually, you can take advantage of accounts receivable automation software. Even better, when you opt for an AR automation solution that prioritizes customer collaboration, you can improve collection times even further by streamlining the way you handle disputes and queries. Also, keep in mind that the average collection period only tells part of the story. To really understand your accounts receivables, you need to look at this metric in tandem with related metrics like AR turnover, AR aging, days payable outstanding (DPO), and more. All these efforts will help you maintain a healthy cash flow, sustain business operations effectively, and reduce your risk of bad debt.