To order a property try a huge doing regarding family relations, however it would be incredibly challenging while just one parent. When you are scared that there’s nobody otherwise so you can bounce ideas of regarding, browse communities, or decide a budget, understand that there are plenty of type anybody and features out indeed there to browse their experience as a primary-day homebuyer.

This article will go through the pros and cons of getting versus. renting so you can determine – as the one mother or father – in the event that taking the plunge can be helpful available to date. However, very first, let’s touch on profit.

Extracting brand new budget

If you find yourself prospective homebuyers take into account a little boost in home loan pricing, it pays to consider you to definitely fifteen% interest levels have been important into the first mid-eighties. Costs haven’t been more than 5% while the 2010, and you will, last year, the average interest rate was only dos.79%. Very even if rates increase, they aren’t predicted to visit over cuatro% from inside the 2022. Meaning homeowners and homeowners are still trying to find pricing which make also today’s large home values affordable.

Bear in mind that just as home prices keeps increased since pandemic come, rents enjoys increased, too. Here are easy loans in Mulford some our mortgage calculator so you’re able to estimate your own monthly premiums to have an evaluation. Then consult with financing manager who can dig into your money to assist develop a personalized homebuying funds to utilize as the a guide.

Advantages of being a resident

Keep leasing and you are clearly subject to a landlord exactly who you are going to increase your book, evict your or promote the building outright. But if you buy a home that have a fixed-rate home loan, their monthly obligations stay a comparable week immediately following times, every year. You to surface helps you package and you will rescue with other expenses later on. Yes, you might be taking up additional property can cost you, such as for example taxation and you may insurance, but people cannot changes you to drastically through the years.

According to a current Government Reserve investigation, in the 2019, You.S. homeowners got an average internet value of $255,000, if you find yourself tenants was just $6,3 hundred. That’s a good 40X differences! It is clear one to homeownership is just one of the just how do i build wealth. As your family appreciates and you pay down the mortgage, you build collateral regarding assets, one thing advantages call pressed offers.

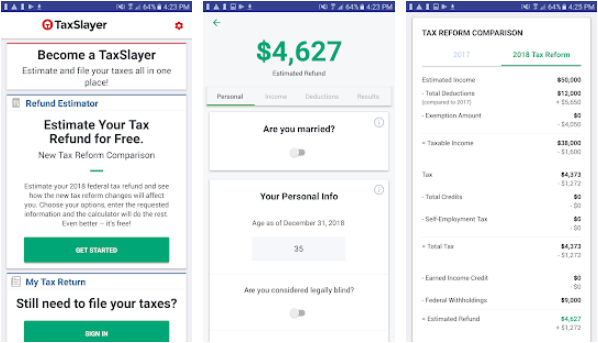

A special benefit of homeownership is inspired by taxes. For individuals who itemize your own yearly deductions, you are able to as well as reduce your taxable money by whatever you’re shelling out for property fees, financial interest and you can – often – mortgage insurance policies. Just remember to dicuss in order to a taxation expert before applying to have a home loan exclusively towards prospective income tax loans – they have been various other in virtually any county.

Clients constantly are not allowed to make any changes on the apartments. Some aren’t even permitted to painting. If you take they up on you to ultimately wade Diy, it’ll most likely emerge from the wallet, maybe not the brand new landlords. However, as the a citizen, you are free to personalize the room in any way your sweat equity or finances enable. In addition to, when you’re an animal manager, you’ve got the freedom to let your furry mate accept you in place of asking for consent!

The feel-a beneficial great things about taking associated with your regional people is an activity you to definitely home owners and you will renters may take region in equally. However, it is true you to definitely clients – specifically more youthful clients – are more inclined to disperse from time to time over ten otherwise fifteen years than just homeowners usually. For this reason they phone call to get a house putting off roots.

While raising a family group since an individual mother, college district high quality is a big part of the where will be i alive decision. It’s great to have high school students to possess a steady community with college chums that they’ll grow up with – these are generally placing down root, as well! So, it is critical to keep an eye on the college district you’ll be able to real time inside the. Find those who are well financed, safe and keeps numerous even more-curricular things for taking the stress away from you given that an only supply of supervision. Plus, you have made the chance to create long-long-lasting relationships on parents of one’s kid’s class mates.

Benefits of are a tenant

When you are to invest in a house represents a no-brainer, there isn’t any verify you will observe an income down the road. Yes, paying down the mortgage and maintaining family restoration creates domestic guarantee, however, there are a great number of issues that are from your control. What’ll brand new discount wind up as when you wear it the newest field? Usually yours end up being one of the homes for sale at that time? Performed a park or a parking lot rating created near your domestic? These all can affect your resale rate, creating your where you can find get rid of from inside the worthy of when it’s for you personally to offer. Renters don’t possess so it over its heads.

When you find yourself a homeowner, you will want to save your self and you will cover house fixes that will be destined to happens ultimately. Having clients, it’s another person’s state. Regarding the expenses while the dilemma off employing anyone to care for solutions on your own apartment, this is the landlord’s headache.

Owning a home cannot keep you from altering efforts otherwise move to a different urban area, but it’s far less simple as only breaking your own lease and dealing with the brand new fall-out. Maybe you will be a tenant who would like a choice of having the ability to modify things up when the residents score as well noisy or even the travel will get also longpared to homeowners, clients usually can act more speedily when designing a shift.

Tenants, of the definition, pay month-to-month book. And lots of ones have to cough up to possess wire, resources and you may – if they’re wise – clients insurance. As well, people pay home loan dominant and you will interest, property taxes, homeowner’s insurance coverage, often mortgage insurance rates, typical maintenance, defense features and all of the brand new resources mentioned above following certain. There are even homeowner’s relationship (HOA) charges to possess apartments otherwise gated organizations. Therefore if you are there are numerous advantageous assets to to purchase a property, homeowners often write a great deal more monitors than just renters perform.

Willing to move on?

While the an individual father or mother, you ily’s sole breadwinner, but determining whether to purchase otherwise rent isnt a simply economic decision. You can find mental products that go engrossed as well. If you want let weighing the huge benefits and drawbacks, do not think twice to extend.

Direction Financial is available to enjoy and cost individuals, and you can we’d will make it easier to determine if to purchase ‘s the correct move to you and, if so, what you could afford. To get going, select a loan administrator in the area your family need to name house!

Mitch Mitchell are a freelance factor to help you Movement’s deals institution. He also produces from the technical, on the web security, this new electronic training society, take a trip, and you may managing dogs. He would need live somewhere loving.