Every person dreams of is a resident. Its a way of making certain lifelong coverage that does not become out-of staying in a rented household. But buying a property isnt an easy process. Whether it’s numerous years of discounts to get provided once the in initial deposit otherwise looking for a real locality to spend, the procedure of buying a home was detail by detail. Since the property money takes the new degrees of money, the some one trust submit an application for home financing. You will sign up for a mortgage and you can repay it within the simple equated monthly installments (EMIs) to possess tenures long-term up-to help you thirty years.

The method to try to get home financing inside Asia relates to numerous procedures, and this before the digitization from financial was basically cutting-edge and time-ingesting to own applicants. Now, the house financing techniques is not just easy also small. The loan is often paid in this every week.

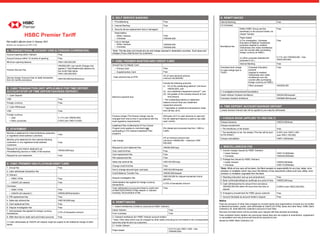

Complete the applying:

The procedure in making our home loan starts with filing an form. The program is considered the most basic file for which you provides to help you fill your very own factual statements about your term, address, number, profession, month-to-month and you will yearly money, and you can training info, etcetera. The debtor should also supply the details about the house or property he would like to get, the projected price of the house or property, additionally the reasonable put. The brand new debtor needs to furnish the latest id proof, address facts, income proof, money licenses, ITR regarding last 3 years, lender statements, an such like, with her on the setting.

Confirmation off data:

When you fill in your posts, the financial institution confirms the fresh new files provided with you. This is often a vital aspect of the mortgage procedure and you will banks usually takes as much as 2 days to confirm your own documents. In this part, it is possible to additionally be requested to visit the lending company and look for a face-to-face interview. This is often brand new bank’s technique for confirming you are designed for paying down your loan from inside the required tenure.

Background Have a look at:

Financial institutions make certain your articles as well as have conducts a different background evaluate of your own borrower’s background. Compared to that impact, the financial institution may make a study foundation the info offered by your in the means as well as your earlier and you will newest domestic tackles, your boss, back ground of the company, workplace contact details, an such like.

Acquiring your credit report:

This process has simplified from the time RBI made it required getting credit agencies to include their clients having a totally free credit history a-year. People credit history a lot more than 750 is considered an effective which is a beneficial sign of just how uniform one has started that have settling earlier money.

The financial often ask you for a non-refundable loan-processing commission. Very banks costs between 0.5 % and 1 percent of one’s amount borrowed given that handling fees. Financial institutions make use of this count to own beginning and keeping our home financing procedure. Not too long ago, particular banking companies have chosen to take so you can waiving financing-processing fees to draw consumers. You need to discuss along with your lender and check out to take advantage of the bonus. not, never assume all finance companies might be hostile on operating fees.

Review off Repayment Skill:

Confirmation of the borrower’s cost capabilities is among the most important region of the house financing techniques. The financial institution could possibly get sanction otherwise refute your property mortgage demand counting about how exactly found it is together with your power to pay the main (which have appeal) timely. Of course the bank facts a great conditional sanction, every specified conditions will need to be https://www.paydayloanalabama.com/maplesville/ met before the loan try paid.

Running the home documents:

After you have the specialized sanction page giving the loan, you will be needed to submit the first property documents on the financing lender, and therefore stays in bank’s custody through to the financing is repaid completely. The original assets documents generally speaking range from the whole strings from control purchase and you will transfers of control inside series till the Purchases Contract performance, appropriate NOCs out-of relevant regulators alongside the seller’s label, ID and you may target evidence, etc. The bank confirms most of the associated assets data ahead of granting the mortgage. Lender together with sends its user twice so you can individually check out the possessions site, immediately after just before acceptance of the mortgage up coming just after sanction of the financing.