What’s a home loan action

If you are intending to utilize your house so you’re able to safer a great mortgage, you must know the idea of a home loan deed.

What exactly is home financing

In advance of looking into the latest details of home financing deed, let’s see the thought of a home loan. A mortgage was a legal contract between a borrower and you can a great financial, in which the debtor pledges their residence just like the collateral for a financial loan. This possessions is going to be residential otherwise commercial. The lending company gets the legal right to take arms of your assets if the borrower fails to pay off the loan.

Form of mortgage deeds

There are numerous variety of financial deeds in accordance with the character of one’s mortgage and you will court conditions. Some typically common sizes are:

- Easy mortgage deed: Here brand new debtor could keep palms of your bound assets. In the eventuality of default, the lender comes with the directly to promote the house or property because of good legal way to get well the a good mortgage.

- Usufructuary home loan deed: In this type, the new debtor transmits brand new hands of the property towards the financial. The lender can be assemble the funds made on property, such rent, to recover the borrowed funds number.

- English home loan deed: It mortgage involves the transfer of your own property’s possession on lender since the safety to your financing. Through to full installment, the lender transfers the house or property back again to new debtor.

- Fair mortgage deed: Here, new borrower places the new property’s name deeds otherwise data files toward financial due to the fact cover into mortgage. The lender will not simply take bodily hands of the property however, contains the directly to sell it in case there are default.

When is the home loan action expected

A home loan deed will become necessary whenever a debtor promises their residence since collateral so you’re able to secure that loan against possessions. So it lawfully joining document outlines the small print of your own mortgage together with legal rights and obligations of your own on it activities.

The mortgage deed is generated during availing brand new financing. It must be joined to your associated bodies power, according to the appropriate rules. Subscription contributes court validity on action and helps prevent conflicts down the road.

Essential components of a mortgage deed

Brands and facts: The borrowed funds action must explore the newest brands and you may contact regarding one another the new borrower plus the financial. It has to along with identify the house being mortgaged.

Home loan criteria: Brand new action is to state the fresh new fine print less than that lender can take possession of the house in the event of standard.

Liberties and you can debts: The mortgage action must detail the new legal rights and debts regarding each other new debtor and the lender about the home loan.

Membership and you will stamp obligations: It has to through the specifics of membership and you may stamp obligations paid off to your deed, according to the appropriate laws.

A mortgage deed is an important document for choosing that loan against property within the Asia. By pledging your home while the collateral, you could potentially take a loan within competitive interest levels to fulfill your varied economic requires.

Currently, we offer Mortgage Against Property has the benefit of mortgage loan starting from 8% so you can fourteen% yearly. New repayment period away from fifteen years* is extremely much easier and you can rating a loan away from Rs. crore*. In the event the monetary constraints are holding you back, upcoming getting that loan up against assets are good nig recovery.

Significance of mortgage deed

- Bank shelter: Will bring loan providers having an appropriate interest in the house or property, becoming cover having funds.

- Equity value: Real-estate sworn from the mortgage action functions as valuable guarantee to own loans.

- Chance mitigation: Facilitate loan providers determine and you can mitigate loans Sipsey AL risks by evaluating this new property’s worthy of and you will status.

- Judge detection: Legally kits the brand new lender’s lien to your possessions, enabling legal action in case there are default.

- Conditions administration: Traces loan small print, providing a legal basis for enforcement in the eventuality of standard.

Disclaimer

step 1. Bajaj Funds Minimal (BFL) try a low-Banking Monetary institution (NBFC) and you may Prepaid service Payment Appliance Issuer offering economic properties viz., money, places, Bajaj Spend Purse, Bajaj Shell out UPI, statement money and 3rd-people money management items. The facts stated in the respective device/ provider document should prevail in the eventuality of people inconsistency in respect towards information writing about BFL products and services on this subject web page.

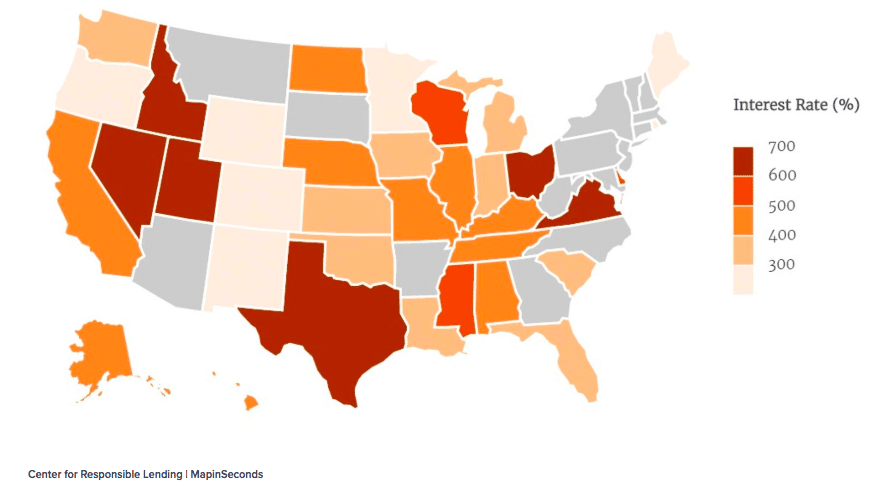

2. Almost every other pointers, for example, the images, points, statistics etcetera. (information) which might be in addition to the details said regarding BFL’s product/ services document and you will that are getting shown on this page simply portrays the fresh breakdown of all the details acquired on public domain. The fresh new told you information is none owned by BFL nor its with the exclusive experience with BFL. There can be inadvertent inaccuracies otherwise typographical errors otherwise delays during the upgrading the latest told you guidance. And this, pages are advised to on their own do it diligence by confirming done advice, also by consulting gurus, or no. Users will likely be the sole manager of one’s elizabeth.

Faqs

A mortgage deed is a vital legal document giving protection toward bank and you can kits the fresh new liberties and you will duties away from one another people in a mortgage exchange. What is important for the debtor in addition to bank to grasp the new terms in depth regarding the home loan deed ahead of typing to the a mortgage agreement.

Home loan data is actually a collection of judge files and you will agreements you to definitely are part of the process of getting an interest rate having a house. Such data files are crucial during the defining the fresh new small print of the mortgage, discussing the rights and requirements off the borrower and bank.

A lease deed kits accommodations agreement, animated the authority to have fun with property from the manager in order to the newest occupant to have a designated period. In contrast, a home loan deed are a file included in home financing exchange, where in actuality the home owner guarantees the home due to the fact security in order to safer that loan. The borrowed funds deed will not import possession however, produces a security demand for the property into bank. The key variations sit in their objectives, the newest transfer of interest, termination conditions, as well as the liberties of your own people on it.

An action out-of Home loan having Fingers was a legal file one formalises a plan where in actuality the borrower (mortgagor) gives arms of the mortgaged assets into financial (mortgagee) just like the protection for a financial loan. So it file is employed within the mortgage deals, plus it contains the bank toward straight to bring bodily arms of the home if there is default from the borrower.