Tata Financing Financial

With the industry as it is the cost of homes is quite high versus paycheck some body build. Discover not too many those who have enough money a property in full themselves and others require the assistance of lenders to shop for their fantasy domestic.

Tata Capital one of several popular banking institutions in the India provides household funds on aggressive rates of interest enabling of a lot so you can get their family.

Taking home financing out of Tata Capital is very simple where one needs to just look online see their site mouse click towards the financial and you may fill out the information questioned. Present users get pre-acknowledged financing predicated on the salary and you will credit score.

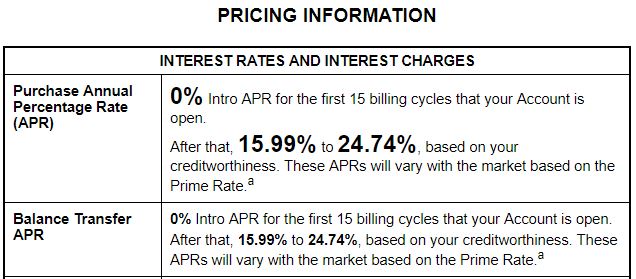

Every facts about the house loan that include interest rate, EMI matter, handling charge etc. are advised in advance and you can make a decision to go for the loan. Shortly after, you have got accepted, the loan count was disbursed into family savings instantaneously.

While we demonstrate in the cash advance Niantic loan example over following the tenue might have been accomplished and you have paid off the eye and amount borrowed in full, you really need to move on to see a certification of the same out-of the financial institution, in such a case Tata Investment.

The financial institution would have advertised your percentage over the tenor to help you the four credit agencies into the Asia and you will adopting the conclusion away from the mortgage the same could be claimed towards the bureaus and you may carry out in the near future reflect on your credit file. New consent in the bank in addition to meditation of the home mortgage just like the a close account was research which you have entirely settled your house financing. Read More