Revisiting the newest AIG Bailout

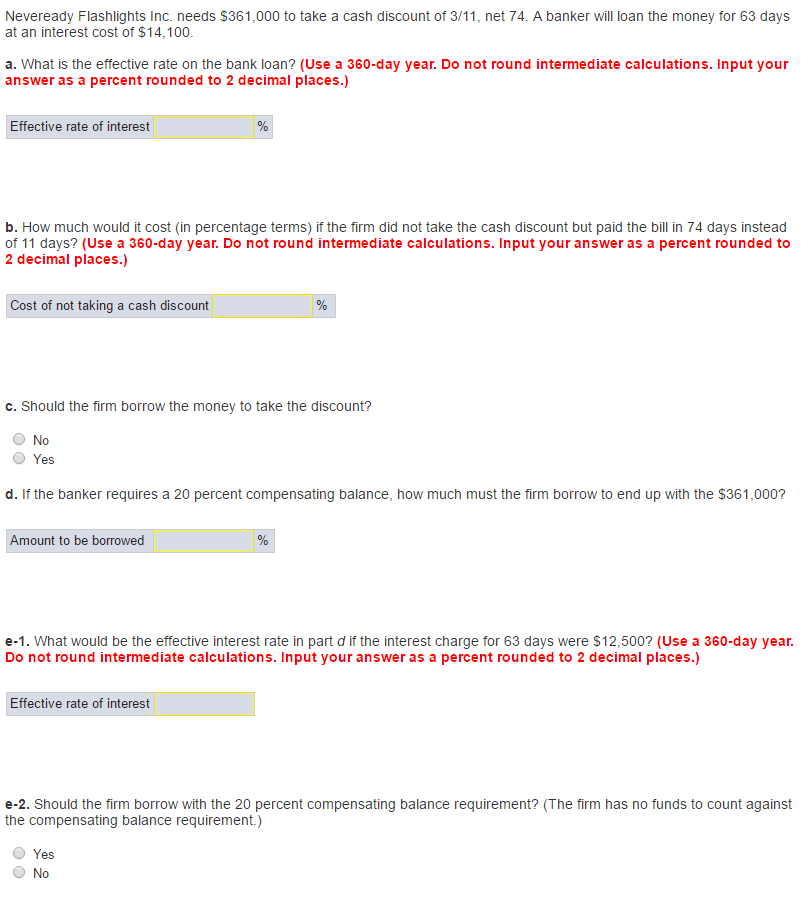

For me, the brand new bailout of your own AIG insurance carrier into constantly stood out of the most other bailouts to that point. If bailing out large banking companies was an essential action or perhaps not, about it actually was visible why the banks was in some trouble: casing costs had dropped sharply, and you can much more someone than simply questioned was indeed failing woefully to pay its mortgages. Similarly, it actually was obvious the sharp shed into the property costs could end in major difficulties to possess Federal national mortgage association and Freddie Mac computer, the two most significant government enterprises that have been to acquire mortgages, bundling them to each other, following reselling them. The new financial hardships out-of GM and you can Chrysler produced specific feel, too: these were currently hampered of the high will cost you, declining business, and difficult competition and if vehicle conversion process collapsed during the Higher Recession, these were bleeding money. But what was the cause of insurance provider such as AIG to shed $100 billion within the 2008? Just how performed an insurance coverage business feel entangled within the a crisis grounded in dropping house pricing and subprime mortgage loans?

Thursday

Robert McDonald and you may Anna Paulson give an explanation for economic image behind the fresh new moments during the “AIG for the Hindsight” on Spring 2015 problem of this new Record regarding Economic Point of views. Read More