There is no minimum credit history called for, while don’t need to provide earnings records or pay for a home assessment. You pay a good Va money percentage that’s .5% of your own the brand new amount borrowed.

High-LTV Refi Requirements

Federal national mortgage association and you can Freddie Mac could be the one or two-monster authorities-paid businesses that purchase and sell home loans off lenders. He’s got multiple programs if you have high LTV ratios; a premier LTV is considered 97% or even more. High-LTV refinance loans are always inside sought after.

You don’t need getting a certain credit history to help you qualify for home financing by itself. Yet not, you simply meet the requirements when you yourself have a traditional loan backed by Fannie mae otherwise Freddie Mac computer. When you have a good rates in your established home loan and you may you want cash out believe a 2nd financial otherwise family security line out of borrowing. Have a look at HELOC borrowing standards now.

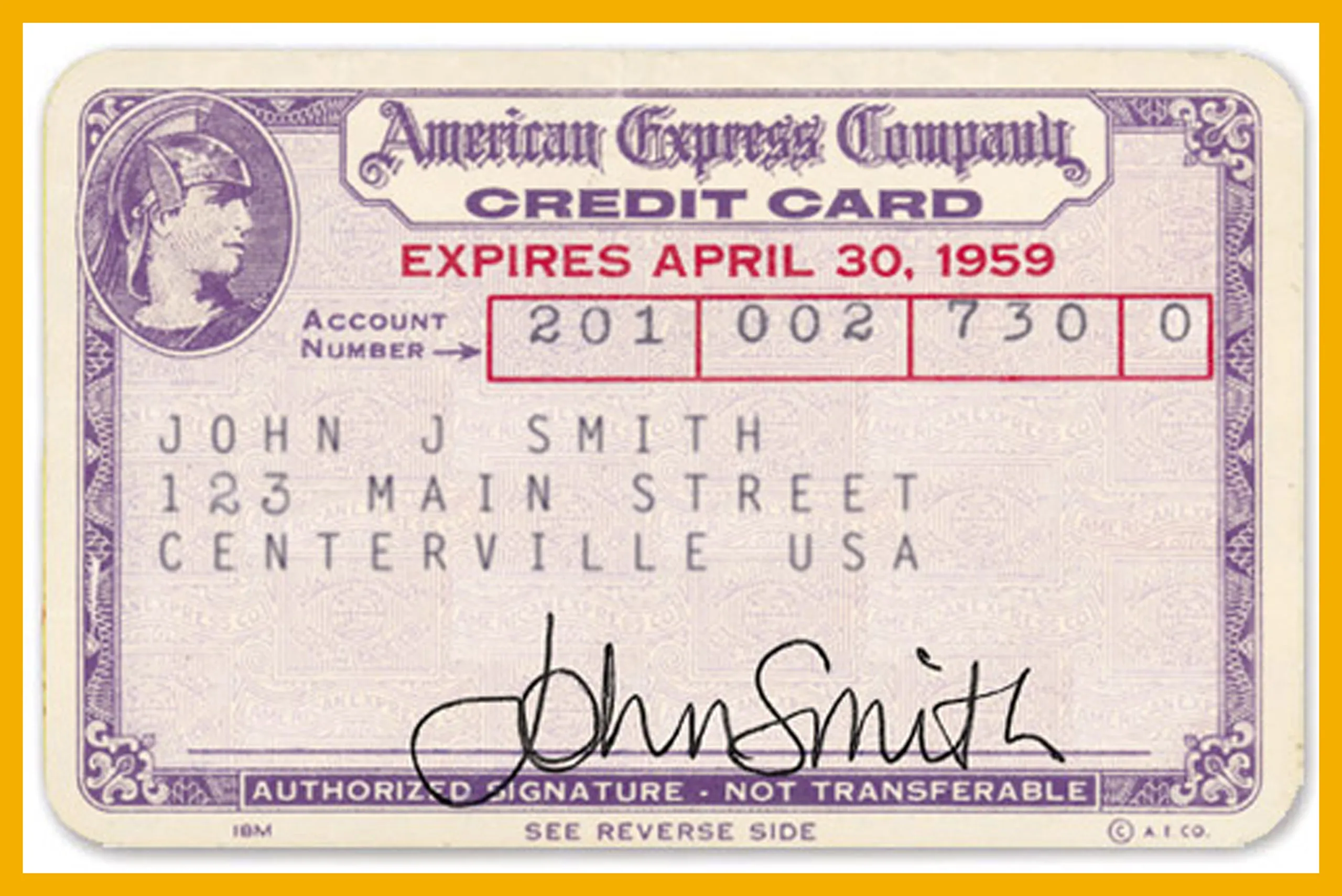

Credit scores was a crucial cause of the borrowed funds refinancing procedure. Lenders make use of your credit score to evaluate the creditworthiness, therefore assists determine the pace, mortgage terms and conditions, and full eligibility for refinancing. Typically, the greater examine this site your credit rating, the higher the brand new refinancing conditions you could potentially safe.

When you are credit score standards can differ certainly one of loan providers and you will financing software, a good rule of thumb is the fact a credit history away from 620 or more is usually the minimal significance of conventional financial refinancing. Yet not, so you can be eligible for one particular competitive interest rates and you may words, needed a credit score well above so it tolerance, essentially on the 700s or higher.

Government-backed apps instance FHA (Federal Casing Administration) and Virtual assistant (Company of Veterans Points) financing might have more easy credit score conditions, leading them to open to borrowers that have down credit scores. Read More