· Oftentimes, medical practitioner real estate loan rates is actually less than jumbo financing rates. Since 2022, “jumbo” money are those bigger than $647,two hundred for the majority section, however, higher in more costly counties. Credit centered on good physician’s finalized a position bargain (in place of exhibiting evidence of earlier in the day income). Read More

Jan, 2025

Just how Mortgage Resource Contingencies Really works (Having Example Clauses)

Breaking: Trump’s tariffs you’ll slap users that have “highest fees and lower revenue” with respect to the bipartisan Tax Foundation. Likewise, his tax proposals you are going to improve taxation for most family of the up to help you $step three,900, with respect to the Cardio having America Improvements.

- A fund contingency try a condition into the a genuine property buy contract which enables a buyer so you’re able to straight back from the contract once they are unable to safe a home loan. Read More

Jan, 2025

Its homeownership program also provides assistance with down costs, borrowing fix, and you may entry to reasonable construction to own pros

Fresno Housing Expert Pros Casing Guidelines, FresnoThe Fresno Housing Power has the benefit of sensible houses apps especially for pros, and additionally down payment advice and you can lowest-attention financing. The applying is made to generate homeownership way more doable to own pros in the Fresno. Explore Experts Property Guidance into the Fresno

Main Area Experts Experienced Homebuyer Advice, FresnoThis nonprofit team offers homebuyer education, deposit direction, and economic guidance to help veterans in the Fresno reach homeownership. It work with providing veterans navigate the reasons of homebuying procedure. Discover more about Central Valley Pros

Supportive Properties to possess Experienced Family members (SSVF) FresnoSSVF will bring construction assist with really low-earnings experienced family that are homeless or at risk of to be homeless in Fresno. This method also offers brief financial assistance, houses counseling, and you may much time-term assistance to own homeownership. Read More

Des, 2024

That will be a great guarantor to have my home loan?

Money can often come between the middle of matchmaking. Besides the monetary effects of defaulting on the financing, it is additionally vital to take into account the potential outcomes in your relationships together with your guarantor, in the event that things happens. Before your own guarantor cues for the, you http://www.paydayloanalabama.com/valley-head will have a call at-breadth talk from this subject to make sure you is actually each other on the same web page.

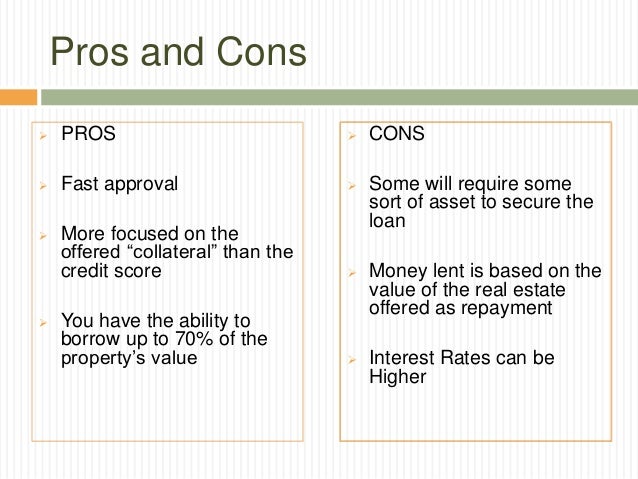

Yet not, do not be frustrated and there is lots of benefits associated with this particular financing which should be similarly regarded as really. To the assistance of a skilled mortgage broker, a guarantor mortgage will likely be an economically viable choice to you personally as well as your guarantor! Gurus include:

- Lacking to pay Loan providers Financial Insurance (LMI)will save you thousands of dollars

- It will be possible to locate home financing even with a smaller sized put

- You will be able to get in the property market faster

- Guarantor money score acceptance more speedily than just finance which have LMI, as LMI financing must be assessed widely

With a beneficial guarantor loan, friends and family otherwise family will help make your hopes for getting property possible. Still, because this is an enormous economic choice, that have an excellent mortgage broker that will make suggestions compliment of all of your own risks and you may great things about this option tends to make every the difference, for you and for the guarantor. Read More

Des, 2024

I would like to generate my community, I do want to build a home,’ Napolitano told you

I purchased a flat fairly intimate immediately following university in the 2008, which in hindsight, I realize, exactly what an adverse date, said transformation professional Julia Napolitano, 32, regarding Milwaukee.

We ran engrossed, really, with this notion of, I wish to introduce me. And in my head, increasing right up in one-house my entire life using my moms and dads, which was its marker.

Immediately following buying her condominium to own $159,000 and residing in they for most many years, Napolitano gone into a rental equipment and you may rented their unique the place to find clients. Read More

Nov, 2024

It had been known the easiest city in the us inside the 2004

Virginia Coastline

Virginia Beach has never generally speaking thought of by the travelers about same white because popular shores out of Florida, Hawaii, otherwise California; but it’s an inexpensive and delightful urban area. Virginia Beach ‘s the nation’s biggest urban area, having a population of approximately 452,602. The city is positioned with each other Virginia’s coastline, which can be a lodge urban area with many different rooms, resorts, and you can food. Ecotourism such as whale watching try well-known recreational use. Annually, the city servers the fresh Eastern Shore Searching Titles.

Very operate from inside the Virginia Beach come in the newest tourism markets, however, there are even many perform throughout the army or any other businesses. According to Virginia Seashore Agency away from Financial Advancement, an estimated $857 billion is allocated to tourist, having fourteen,900 operate providing so you’re able to dos.75 mil individuals annually.

The city is home to several military basics including the NAS Oceana and you may Studies Assistance Heart Hampton Courses and Shared Expeditionary Feet East; they are both elements of the us Navy. Significant organizations in town were Geico, VT Category, Religious Broadcasting System, and the Western head office getting Stihl.

Richmond

Richmond ‘s the financial support town of Virginia, that have a society off 223,170. The metropolis has a wealthy colonial background, with many museums and a wide variety of activity venues. The town has been called an excellent foodie town, being well-recognized for its southern area cuisine. Nearby the town are also several theme parks such as Leaders Rule and you can Busch Home gardens.

Richmond’s economy is mostly supported by operate in-law, money, and you can authorities. The greater Richmond area has been rated from the MarketWatch the next best town in the usa in which to start good home business. Read More

Nov, 2024

Va implies another low-substantive transform so you can

First, Va offers to correct a reference mistake in the paragraph (a)(4)(ii). Current paragraph (a)(4)(ii) improperly records (a)(4) as supply in accordance with financed energy saving developments. A correct reference is (b). Likewise, getting ease of training, Virtual assistant proposes to input part titles into the newest

step three. Additional Recoupment Issues

(a)(4), (a)(5), (a)(6) and you will (a)(7); the brand new titles being: Limit Number of Refinancing Loan., Cases of Delinquency., Guarantee Number., and you may Loan Name., correspondingly. Read More