Exactly what are the Dangers of Refinancing to get rid of a Co-Borrower?

Refinancing to remove a great co-borrower regarding a mortgage have advantages, according to individual’s things. Refinancing will help slow down the overall weight out of debt, given that eliminated borrower no further must sign up for the mortgage costs. Then, it assists so you can clarify the loan, particularly if the co-borrower provides a new finances towards top borrower.

An important borrower also can benefit from taking up the full mortgage, because can help to increase their credit rating. Since removed debtor no longer is responsible for the mortgage, its credit rating will never be adversely affected. This might be of particular advantage to people who find themselves worry about-functioning or that have a volatile earnings, due to the fact refinancing can help enhance their overall creditworthiness.

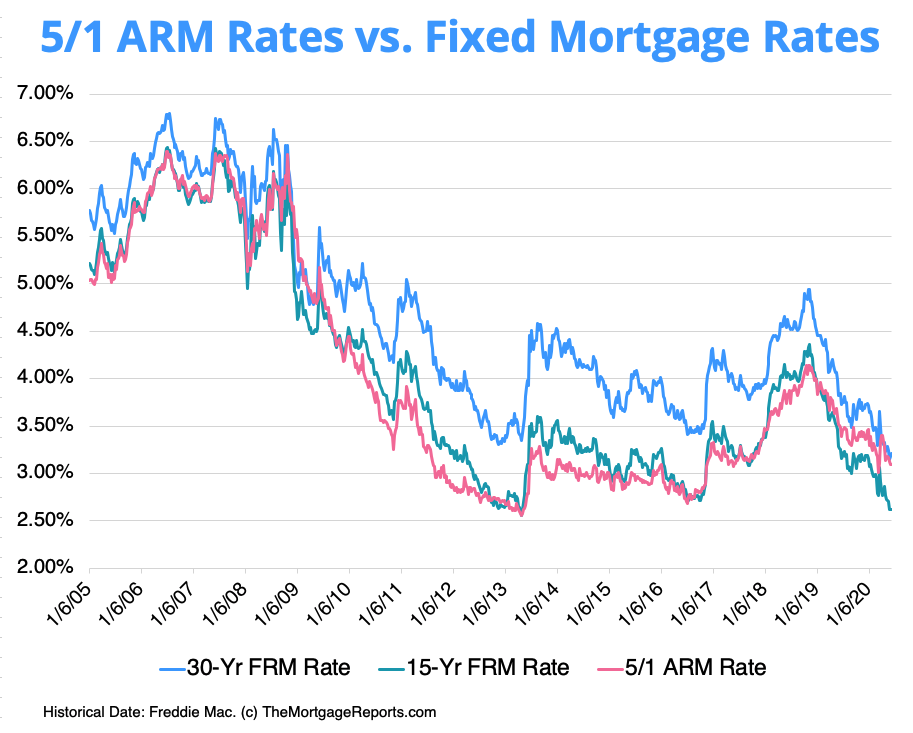

Then, refinancing to eliminate a good co-borrower also provide the chance to slow down the mortgage interest rate. As the no. 1 borrower has started to become entirely guilty of the loan, they can so you can safe less rate of interest, leading to down money. This may bring a cheaper financing and help so you can totally free up a great deal more disposable earnings.

When it comes to refinancing to get rid of good co-debtor, you should look at the time of your processes, while the associated can cost you. Refinancing can cover significant can cost you when it comes to costs and you can costs, so it’s crucial that you envision if the potential discounts try worth the initial prices. On top of that, whether your mortgage is not but really near to maturity, it can be best if you hold back until the loan is closer into stop of their term, since this can help reduce the total costs.

Great things about Refinancing to eradicate a good Co-Borrower

At some point, refinancing to eliminate good co-debtor was a decision that should be carefully considered. Read More