“‘A fiduciary relationship . . . concerns a duty on behalf of the newest fiduciary to do something with the advantage of additional people to your relation while the to help you things into the extent of your own family members.'” Lasater v. Guttman, 5 A beneficial.three-dimensional 79, 93 (Md. Ct. Spec. Application. 2010) (quoting Buxton v. Buxton, 770 Good.2d 152, 164 (Md. 2001) (citation and estimate marks excluded)). It is more an excellent “‘confidential relationships,'” which merely necessitates that one party “‘has achieved the latest rely on of one’s other and you will purports to behave otherwise indicates toward other’s interest in head.'” Id . (quoting Buxton, 770 An effective.2d on 164 (citation and quote ples off fiduciary relationship is “‘trustee and you will beneficiary, guardian and you may ward, broker and you may principal, attorneys and you can client, partners into the a collaboration, business directors as well as their agency.'” Id. (ticket and you can quote marks excluded). Read More

Jan, 2025

This is why the audience is worried about mortgage loans and you may automobile financing, as opposed to credit card receivables and you may personal loans

DP: Fundamentally, our company is fairly positive towards the exposure, even if we feel we are going to enjoys highest pricing for lengthened and you will a gentle recession in the usa in the specific point. While doing so, we are meticulously due to the cost regarding homes and what you to you are going to indicate to your capital thesis. Read More

Des, 2024

C. Considerations off Differences when considering banking institutions while the Businesses

Originating in 2000, many of the conditions within the FMP was superseded by the regulations used by Finance Board plus statutes one to accompanied new the fresh investment framework towards Banks that were required because of the the fresh Gramm-Leach-Bliley Operate out-of 1999, Personal Laws No. 106-102, 113 Stat. 1338 (ong other things, the newest financing build provided exposure-mainly based money conditions to help with the dangers regarding Banks’ activities, and this eliminated the necessity for all FMP restrictions into assets. See12 CFR part 932. During the granting the capital agreements that every Bank had to follow advance cash Pollard Alabama below provisions of your own GLB Operate, the latest Funds Panel awarded independent commands providing that upon a Bank’s implementation of its money package and its particular full dental coverage plans by financing techniques in part 932 of the guidelines, the bank would be exempted from upcoming conformity with all of specifications of your FMP with the exception of several certain limits regarding new Bank’s capital inside the home loan-supported and particular advantage-recognized bonds as well as particular related limits with the stepping into particular derivative purchases. Come across, age.grams., Fin. Bd. Res. Zero. 2002-eleven (). Already, all of the Finance companies however the Government Mortgage Financial away from il ( il Bank) has actually used the capital plans and are usually fully at the mercy of brand new region 932 capital conditions. Ergo, not all of the arrangements of your FMP continue to be relevant to all or any Finance companies.

Point 1201 out-of HERA necessitates the Director, whenever promulgating legislation regarding the Banking companies, to adopt next differences when considering financial institutions therefore the Enterprises: Cooperative possession framework; mission away from taking exchangeability so you’re able to players; sensible houses and people invention objective; financial support structure; and you can joint and many accountability. Read More

Des, 2024

A defined sum plan contains the definition established within the Interior Funds Password point 414(i), twenty six U

iii. Pooled settlement. Point (d)(1) prohibits the fresh new sharing of pooled compensation among mortgage originators exactly who originate purchases with assorted words and so are compensated differently. Including, believe that Loan Inventor An is receiving a higher percentage than just Financing Founder B which fund got its start by the Loan Originator An usually possess highest rates than funds began because of the Financing Inventor B. Less than these circumstances, both loan originators may not show pooled settlement as for every gets payment based on the terms of this new transactions they with each other build.

Lower than a low-deferred earnings-centered settlement bundle, anyone financing founder ple, be distributed in direct dollars, stock, and other low-deferred payment, as well as the compensation in low-deferred payouts-mainly based payment package tends to be influenced by a predetermined algorithm or can be within discernment of the person (age

i. Designated income tax-advantaged preparations. Point (d)(1)(iii) it permits one financing originator to receive, and you will anyone to pay, settlement when it comes to efforts to help you an exact contribution package otherwise professionals below a precise work with plan given the master plan is actually a selected income tax-advantaged bundle (due to the fact discussed in (d)(1)(iii)), regardless of if efforts to help you or gurus less than for example agreements is actually physically or ultimately in line with the regards to numerous purchases from the numerous private financing originators. In the example of a selected taxation-advantaged package that’s the precise contribution bundle, (d)(1)(iii) will not permit the contribution to be really or ultimately based on terms of that person financing originator’s purchases. S.C. 414(i). A precise work for plan has got the meaning established for the Inner Funds Password part 414(j), 26 You.S.C. 414(j). Read More

Nov, 2024

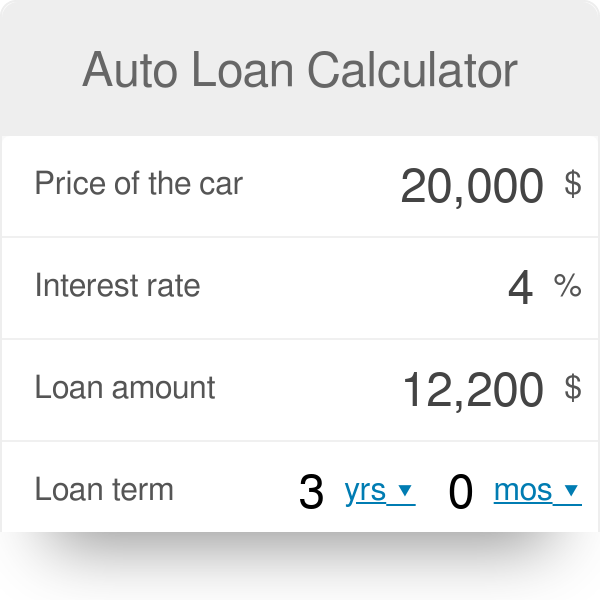

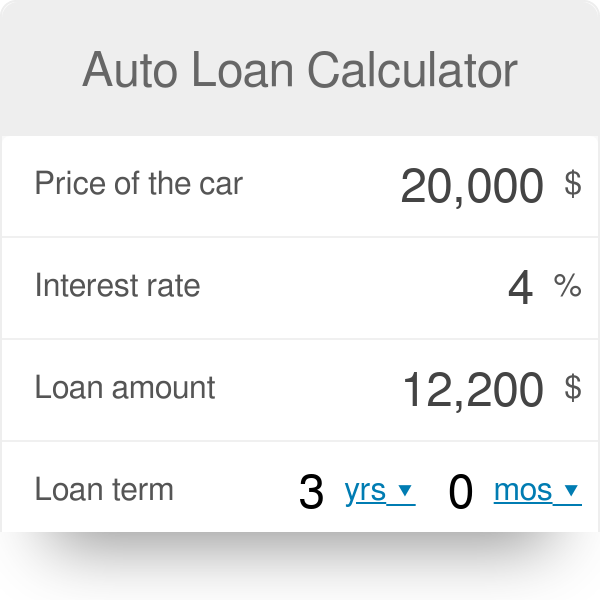

The main thing to watch out for when you look at the small town banking companies would be the fact mortgage term

I wish, should, want to they will go longer. As to the reasons, oh why cannot each goes completely adverts particularly a property? I am not sure. I absolutely wish they’d do that even so they would not. Therefore typically you’ll get a smaller financing identity prior to you have made an excellent ballon inside it. Make certain whenever you can to keep one no less than away five years assuming you loan places Sacred Heart University could potentially push because of it, strive for 7 or ten. Read More

Okt, 2024

Pennymac to help you issue $650M from inside the consumer debt

Pennymac also advised the business recently that an arbitrator concluded the organization has to spend $155

- Simply click to share to your LinkedIn (Opens up in the the windows)

- Simply click in order to email address a relationship to a buddy (Opens up within the brand new windows)

- Click to talk about to the Text messages (Opens from inside the the new screen)

- Click to replicate hook up (Opens in the the brand new windows)

Pennymac Monetary Qualities ‘s the latest mortgage company so you can thing financial obligation within the a difficult housing industry. This new Ca-oriented organization established into Wednesday they plans to offer a great $650 billion aggregate prominent number of senior cards due in the 2029.

Arises from the newest offering could well be familiar with pay off a portion of your own Organization’s protected name notes due 2025 as well as almost every other general corporate intentions, Pennymac told you from inside the an 8-K filing towards the Bonds and Change Percentage (SEC).

Analysts find home loan people providing financial obligation since the an indicator that . Lenders was raising extra money to shop for the company, improve exchangeability while increasing the fresh new show off personal debt, without any collateral, to their balance piece.

In October, HousingWire stated that Versatility Financial and you may PennyMac Mortgage Money Trust went to boost currency through debt products with a high trader request. Particularly, Liberty increased $step 1.step three billion in about twenty four hours, greater than new $step one million expected of the team, showing an oversubscribed package.

California-established nonbank lending company Pennymac Financial Services’ net income fell even more than just fifty% in the first quarter throughout the same several months in 2021, motivated of the lower winnings from the development sector on account of surging home loan costs and you will a shrinking origination markets

Pennymac Financial Services said the cards, getting available in a personal position to help you licensed institutional buyers, would-be fully and unconditionally protected for the an unsecured senior foundation. Read More