As a way to balance new housing industry and you may assist troubled residents to avoid foreclosure, President Barack Obama expose new Citizen Value and Balance Intend on . The program appears to render far more realities than the Economic Stability Plan announced the prior week. Nonetheless, facts of the specific aspects of the plan continue to be challenging.

The brand new Homeowner Cost and Balances Bundle was an essential component from the president’s total method to stimulate the latest Western savings and you can slow down brand new ongoing impression of your internationally credit crunch. The master plan, along with elements of this new Western Healing and you may Reinvestment Operate finalized into the legislation on , seeks to balance the brand new housing market, boost lending in addition to flow from credit rating, and you can reform the Western economic climate.

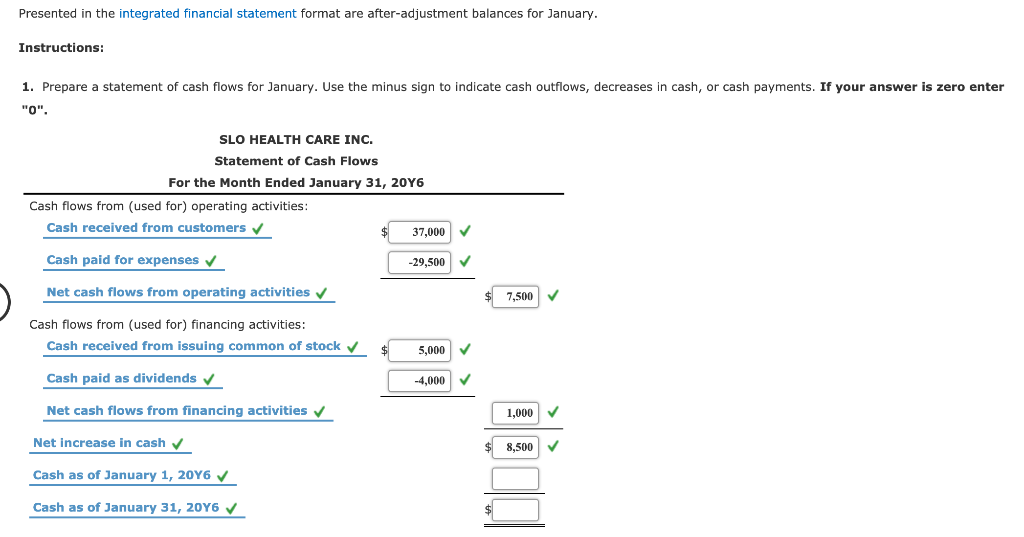

Stressing that financial crisis as well as the greater financial crisis is actually “interrelated,” President Obama summarized the latest center elements of the latest Resident Affordability and you will Balances Bundle below: