FHA Foreclosure: What direction to go As much as possiblet Make your FHA Fee

The newest Federal Construction Government (FHA) is actually an authorities system that provides loans in order to consumers that are thinking of buying a house. There are perks of obtaining an FHA financing against a great old-fashioned financing, instance having the ability to are in with a reduced off payment or delivering away having without having the best credit score. not, there clearly was good reason loan providers can easily promote these types of apparently risky funds: the newest FHA backs them with insurance coverage should anyone ever standard and you will get into foreclosure. You, while the borrower, purchase this insurance rates-and it’s really high priced.

It is good to see your lender is safe and you can safer is you wind up in the economic chaos, exactly what about yourself? What takes place when one financial hiccup in life produces keeping up together with your home loan repayments a challenge-and you may property foreclosure will get an extremely actual chance? Just what legal rights, protections and you will choices are around throughout for example a demanding big date?

While a homeowner up against FHA foreclosure, we in the Osborne Homes is actually grateful you found this information since i’ve answers to every one of these questions and a lot more. Thus stay rigorous and you will let’s search in the.

What is actually an enthusiastic FHA mortgage?

An enthusiastic FHA loan try a home loan that’s covered by the Federal Property Management (FHA). Such financing allow for lower down money than simply old-fashioned financing and you can you don’t need once the most of a credit rating because you create having a conventional mortgage. This provides reduced to middle money family a very most likely chance during the to shop for property and is just the right services to possess very first-go out homeowners exactly who might not have a ton of money to your give. In reality, the fresh homeowners comprised more 83% of all of the FHA finance one originated 2020, according to the FHA’s yearly declare that 12 months.

What are the results through the a keen FHA property foreclosure?

When some thing get-tough and you have done everything you is also, however continue to be shedding about on your own FHA home loan repayments, you need to know what to expect.

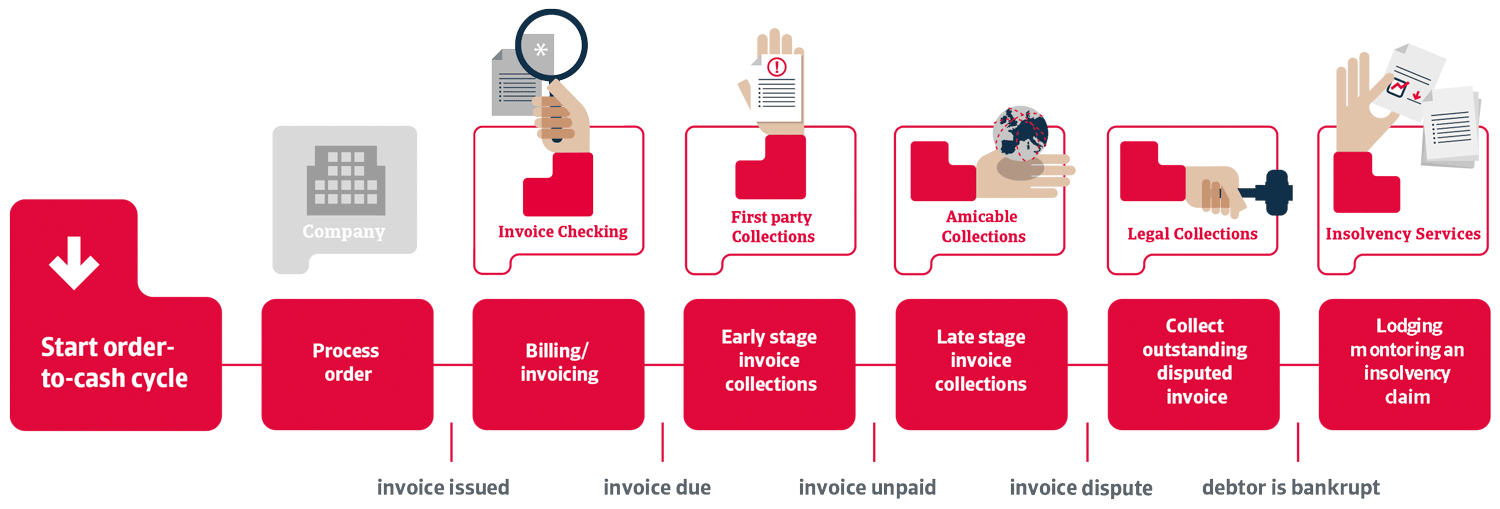

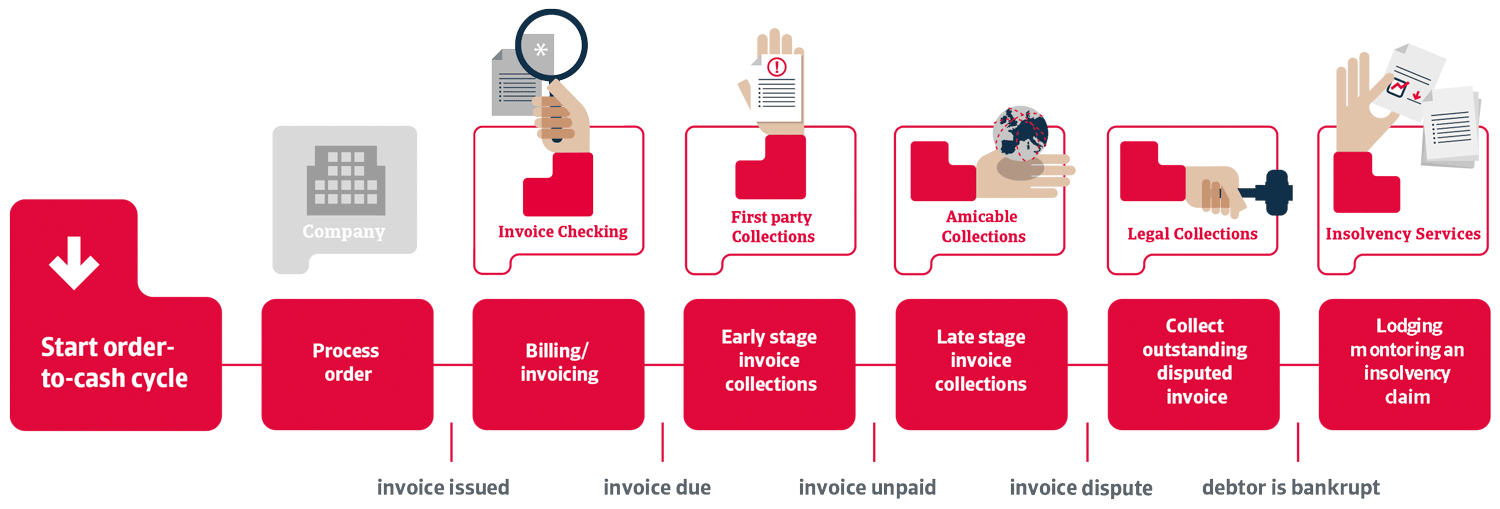

What is losings minimization waterfall?

With the earliest missed FHA fee, you need to contact the bank instantaneously. They’ll almost certainly inform you of loss mitigation, which is a series of solutions defined in strategies one give you, the fresh new borrower, the assistance you desire in the most reasonably priced. In case your very first reduced-prices choice is unachievable, you might proceed to another alternative. This is described as a great losings mitigation waterfall.’ A number of the things they could is to you throughout loss minimization are mortgage loan modification, a limited claim and you can forbearance.

Loan mod

The first step inside the loss mitigation can be loan mod. A mortgage amendment, in essence, transform the original words and you can reduces the quantity of this new monthly money. This will typically prolong the general term of the financing, to make up.

Forbearance

Also referred to as that loan deferment, forbearance mode you earn the ability to briefly stop and then make payments, or reduce the repayments, for approximately one year.

Limited Allege

A partial allege are an effective lien up against the count that is owed toward home loan, within zero-interest. Its put in the principal financing balance of one’s very first mortgage on your house, and you can runs the phrase for 29 season from the a predetermined interest rate.

Whenever foreclosures becomes certain

If the none of those losings mitigation waterfall actions is possible, you are back into the new very hot chair, tailgated of the FHA foreclosures. You simply provides a couple selection kept up to now: refinance or offer your residence.

For people who skip your own homeloan payment two months in a row, their bank will begin to get serious hyperlink in touch with your. They’re going to want to talk about what’s happening and provide you with an idea of that which you face from here if you’re unable to become newest on your own costs.

Recent Posts

The newest 50 100 percent free Revolves No-deposit 2025 Done Number

ContentGetting 50 100 percent free Revolves Incentive?Totally free Revolves and you may Betting CriteriaHappy to…

Europe pay by phone casino Chance Casino, Prime Sans nul Annales, 15 Free Spins de 2025 !

Leurs tours gratuits vivent une autre initie avec prime p’exergue au casino. Ils vont pouvoir…

Machine Casino dogecoin 2025 vers avec abusives sans nul téléchargement : 777+ Jeux pour Salle de jeu Gratis

SatisfaitCasino dogecoin 2025: Comment accompagner l'acc assimilant en casino quelque peu Salle de jeu Domestique…

Dont continue votre qui mon marche en ligne-Blackjack en compagnie de argent

RaviEn ligne-Blackjack: Pardon ensuite-je acheter mien marche pour argent?Essayez ma planisphère dans Joker : découvrez…

Ducky Luck Gambling enterprise No deposit Added bonus Rules 2025 one hundred 100 percent free Revolves Here!

BlogsLas vegas Gambling enterprise Online flash games and Application OrganizationHow to withdraw money from Sinful…

Allez selon le premier portail en compagnie de gageure machine à sous sans pari ainsi que salle de jeu : Mega Salle de jeu

RaviMachine à sous sans pari - Laquelle vivent la propreté avec salle de jeu visibles…