He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

Prepaid Expenses Guide: Accounting, Examples, Journal Entries, and More Explained

The matching convention requires allocation of the expenditure between the asset that represents the remaining economic benefits and the expense that represents the benefits used or consumed by the firm. You may want to set up an amortization table to track the decrease in the account over the policy term and to determine what the journal entries will be. As a digital nomad for nearly three years, JT’s travels prove that credit card rewards can drastically reduce the cost of travel.

Impact of prepaid expenses on liquidity ratios

In this journal entry, the company records the prepaid insurance as an asset since it is an advance payment which the company has not incurred the expense yet. This means the company should record the insurance expense at the period end adjusting entry when a portion of prepaid insurance has expired. Unexpired or prepaid expenses are the expenses for which payments have been made, but full benefits or services have yet to be received during that period.

- This method guarantees that expenses are accurately allocated during the prepaid period, reflecting the steady utilization of insurance coverage.

- Prepaid expenses also arise when a business buys items such as stationery for use within the business.

- Prepaid insurance is initially recorded as a current asset in the general ledger.

- Prepaid insurance is of great importance to any business, as it ensures that there is no loss in insurance coverage due to missed payments.

- Most prepaid expenses appear on the balance sheet as a current asset unless the expense is not to be incurred until after 12 months, which is rare.

- This is usually done at the end of each accounting period through an adjusting entry.

What Is a Prepaid Expense?

HighRadius Autonomous Accounting Application consists of End-to-end Financial Close Automation, AI-powered Anomaly Detection and Account Reconciliation, and Connected Workspaces. Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks. This blog covers the ins and outs of prepaid insurance, its importance, advantages, examples, ways of recording, calculations, and much more. Prepaid expenses are classified as assets because they represent money that the company has not yet spent.

Examples of Two Methods for Recording Prepaid Expenses

Note that in this example we established a short-term and long-term prepaid component because the initial payment was for a two-year subscription. The long-term subscription prepaid represents the value of the subscription paid for in advance beyond 12 months and is amortized at the beginning of the subscription term. The short-term subscription prepaid represents the value of the subscription to be used over the immediately following 12 months and is amortized after the long-term portion of the prepaid subscription is reduced to zero. The proceeding amortization schedule illustrates the appropriate amortization of the short-term and long-term portions of the prepaid subscription. In this scenario, we would record a prepaid asset at the beginning of the contract and the expense of the subscription would be realized over the course of the year.

How do I qualify for a TSA PreCheck or Global Entry credit card?

- Prepaid expenses may need to be adjusted at the end of the accounting period.

- Thus, prepaid expenses aren’t recognized on the income statement when paid because they have yet to be incurred.

- Regardless of whether it’s insurance, rent, utilities, or any other expense that’s paid in advance, it should be recorded in the appropriate prepaid asset account.

- Recording prepaid expenses must be done correctly according to accounting standards.

- Prepaid expenses result from one party paying in advance for a service yet to be performed or an asset yet to be delivered.

- That’s because many credit cards reimburse the application fees or membership fee as a benefit of being a cardholder.

TSA PreCheck is beneficial for going through security clearance more quickly and with less hassle, whereas Global Entry is beneficial for entering the U.S. from abroad. If you are interested in having both benefits, you should apply for Global Entry. Forbes Advisor uses data from multiple government agencies to determine how much a typical cardholder might spend. We use the same numbers for cards in the same category to make sure we are comparing cards the same way. The bonus categories for spending included with each card are factored into our determination of how many rewards a cardholder could expect to earn if they use the card as a consumer normally would.

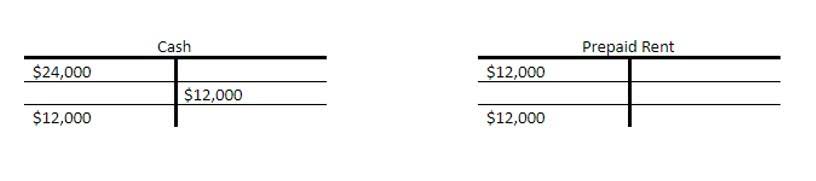

Journal Entries for Prepaid Expenses

Therefore under the accrual accounting model an entity only recognizes an expense on the income statement once the good or service purchased has been delivered or used. Prior to consumption of the good or service, the entity has an asset because they exchanged cash for the right to a good or service at some time in the future. In this example, let’s assume we purchase a 12-month cyber insurance policy for $1,800 on January 1st, 2023. The term of the policy is only 12 months, therefore we will not recognize any long-term prepaid asset.

That’s because many credit cards reimburse the application fees or membership fee as a benefit of being a cardholder. Of the total six-month insurance amounting to $6,000 ($1,000 per month), the insurance for 4 months has already expired. In the entry above, we are actually transferring $4,000 from the asset to the expense account (i.e., from Prepaid Insurance to Insurance Expense). Prepaid insurance is of great importance to any business, as it ensures that there is no loss in insurance coverage due to missed payments. Advance payment of insurance enables a business to manage its cash flow and budget since it assures that insurance needs are covered for the prepaid period.

Transform your Record-to-Report processes with HighRadius!

They do not record new business transactions but simply adjust previously recorded transactions. Adjusting entries for prepaid expenses is necessary to ensure that expenses are recognized in the period in which they are incurred. According to generally accepted accounting principles (GAAP), expenses should be recorded in the same accounting period as the benefit generated from the related asset. For example, if a large copying machine is leased by a company for a period of 12 months, the company benefits from its use over the full-time period. The company can record the prepaid insurance with the journal entry of debiting the prepaid insurance account and crediting the cash account. The current ratio is a useful liquidity metric to evaluate whether a company can meet its short-term obligations by utilizing assets which can quickly be converted into cash.

Prepaid expense is an accounting line item on a company’s balance sheet that refers to goods and services that have been paid for but not yet incurred. Recording prepaid prepaid insurance entry expenses must be done correctly according to accounting standards. They are first recorded as an asset and then, over time, expensed onto the income statement.