An introduction to Home Depot Financing

The home Depot Business also provides financially rewarding money choices to the consumers. Consumers to acquire devices, gadgets, and you may home improvement situations may use money alternatives supplied by Domestic Depot.

It is a convenient method for people as they do not need certainly to apply for 3rd-people investment. Family Depot even offers money using their leading user and you may endeavor credit notes which have different mortgage terminology.

The loan software process is easy and you will users can put on on the internet or by visiting a shop. The application form recognition conditions, rates, or any other conditions differ into some issues (chatted about less than).

Home Depot Credit card

Citi lender. not, as opposed to almost every other handmade cards, they are able to simply be used for shopping from the Domestic Depot stores and you may online sites.

So it mastercard also provides 0% rates if consumers pay an entire number contained in this six months. Yet not, you are going to need to spend accumulated notice for those who have any left balance after the promotional several months.

- 0% interest if the paid down within six months of the advertising period for the orders out of $299 or maybe more.

- Changeable Apr to own important fees terms out-of -%.

- Later Payment fee out of $forty.

- To twenty four-weeks away from payment terminology depending on the credit matter.

- No annual charge.

House Depot Project Loan Charge card

The home Depot investment financing is for customers shopping for larger home improvements. This financing is up to $55,000 for your home restoration and improve expenditures.

The project financing mastercard can also be used only at your house Depot areas to have searching. Customers provides to 6 months to totally need the approved loan amount.

- Includes a credit limit regarding $55,000

- Zero annual fee

- Mortgage terms of 66-, 78-, 90-, and you will 114-months

- Repaired APRs of 7.42%, %, %, and you may % correspondingly for terms in the above list.

Household Depot Charge card Application Procedure

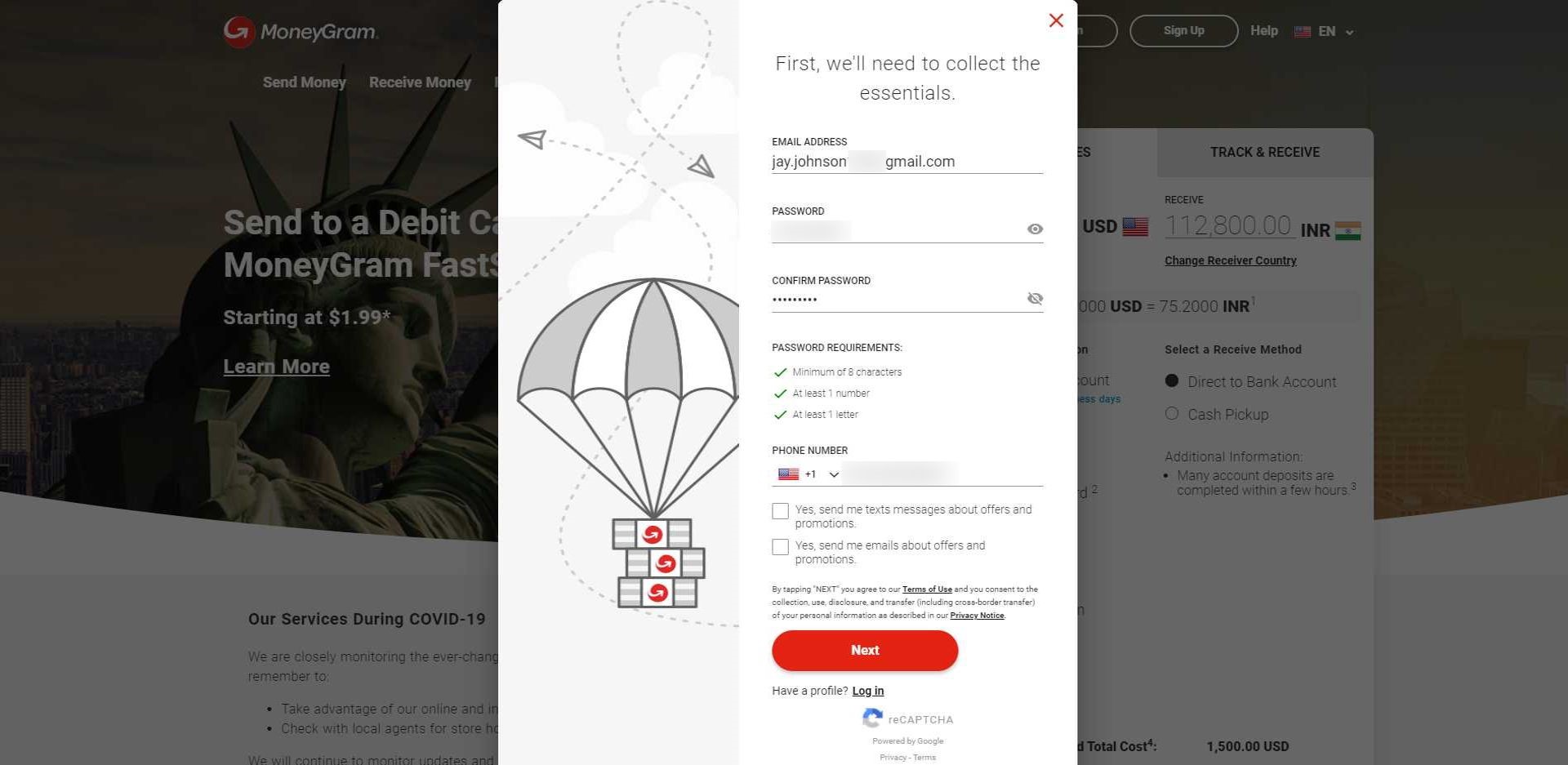

Users can apply on line or from the Household Depot stores to possess their well-known mastercard. The house Depot credit heart product reviews apps and protects the loan procedure.

There is no prequalification stage during the Family Depot resource features. It indicates you’ll encounter a challenging borrowing from the bank query once you apply for a charge card your house Depot.

The actual conditions and the recognition procedure is dependent upon many affairs as well as your money, borrowing reputation, and you may past history.

Home Depot Loan Rejected 5 Factors You need to know

Even though you accomplished every piece of information and you can paperwork criteria, there isn’t any guarantee that your residence Depot opportunity financing tend to become approved.

Bad credit Score

Our home Depot and its own resource partner often assess their credit rating like most most other bank. There is absolutely no reference to minimal credit rating requisite theoretically whether or not.

not, in the event your credit score are crappy, its likely that your loan software might be refuted. In case your almost every other research metrics is actually crucial, then you’ll definitely you want a higher still credit history to progress which have a software.

Warning flag on the Credit rating

Lenders view your credit score to evaluate your track record. He is constantly keener to know the way you paid your previous financing.

If the credit history suggests late monthly installments, delay payments, default, otherwise bankruptcies, your odds of mortgage approval is thin.

Your debt-to-Income is actually Large

The debt-to-income ratio shows just how much of revenues goes towards your month-to-month financing costs. It means whether or not it proportion is highest, you have a tiny pillow so you can serve an alternative financing. Like any most other bank, House Depot may also be curious to see less debt-to-money proportion on your borrowing character.

A major reason for any loan rejection is the fact your income resources try erratic. It indicates you don’t need a protected or long lasting money resource.

It sounds as well obvious however you might have offered the new wrong information regarding your loan software that’ll trigger good getting rejected.

Such as for example, it is possible to enter the specifics of a good cosigner and go wrong. Furthermore, people omission otherwise mistakes in your applications can result in that loan getting rejected too.

Ideas on how to Change your Approval Chance yourself Depot?

You can reapply during the Family Depot getting a different sort of opportunity loan otherwise a consumer credit card anytime. But not, it does apply to your credit score since it incurs a painful pull and you loan for non immigrant us visa will minimizes your credit rating.

Possibilities so you can Household Depot Opportunity Mortgage

Reapplying during the House Depot for a project financing could cost your credit score circumstances. You can test a few selection to the consumer credit credit while the endeavor loan.

Thought some other do it yourself financing provided by a professional lender, borrowing from the bank relationship, otherwise individual financial. Specific lenders deal with applications with various recognition requirements.

You might take a more antique approach to fund your property improvements through the use of having property line of credit or line out of collateral based your circumstances.

When you yourself have established domestic equity, you can use it given that a promise to help you safe a personal mortgage. You can use it accepted personal loan for your goal and your residence update requirements.

Eventually, when your current financials don’t let getting a new loan, you can refinance one of your established loans. You can refinance a consumer loan, a home loan, if not bank card financing to make a support for your do it yourself sales.