In this book

I’ve seen you to struggling consumers can switch to a destination-just financial to possess six months without one impacting their credit rating. I’ve been hit difficult by the cost-of-living crisis. I am today for the an effective 5% fixed financial should i result in the temporary option? Would it be worth every penny?’

Have you got a repayment regarding life style matter you want replied? Be connected and you will I will be answering all of them all of the Saturday:

Which depends. The us government keeps asked banking companies and you will building societies in order to temporarily relax guidelines for the repayments because of heavens-highest interest levels.

Less than these tips, property that are having difficulties is change to appeal-just mortgage repayments for six months without one impacting its credit rating. Yet not, paying interest yet not paying off the money owed will likely mean high payments later, so it is a choice which will never be pulled gently.

That have a regular desire-only home loan, you will only spend the money for appeal each month, to your amount borrowed kept a comparable. Your monthly obligations would be down however, at the conclusion of the loan identity, the full count you borrowed must be paid off inside one lump sum payment.

The difference toward plan that has been has just launched is that although many loan providers currently enables you to go on to an appeal-simply financial for a little while when you’re battling, the loan button according to the government-recognized methods will never be submitted in your credit file or want then value checks.

Exactly how switching to appeal-only affects the financial

Interest-only is but one you’ll be able to method for those who want to eliminate its monthly mortgage payments since the large costs are extending the spending plans to the maximum.

As one example, large financial company Habito states that somebody which have a great ?250,000 home loan becoming paid over 25 years, on a two-seasons repaired rate of 5%, pays ?step 1,461 thirty days. When they turned to an entirely interest-only contract, their month-to-month will set you back carry out fall in order to ?step 1,041.

Basic, the complete desire statement along side lifetime of the mortgage tend to probably be substantially high to possess an attraction-only financial than simply a cost home loan.

2nd, there may should be a choice installment package in position towards borrower to get rid of attaining the avoid of the home loan name without having any capacity to repay new the harmony.

If one makes the fresh short-term option, the quantity your debt into possessions loan alone does not transform to have six months and the focus expenses might possibly be high than simply it might if not had been while the financing isn’t any quicker. Which means you’ll have to enjoy hook-right up, both as a consequence of home loan overpayments later on, otherwise of the stretching their home loan identity, or by loans in New Britain making typical overpayments over the years.

Really repaired-speed installment-home loan business allow borrowers and come up with overpayments regarding ten% of full mortgage on a yearly basis as opposed to taking on penalty charges.

Thus, in theory, make use of an interest-simply financial briefly but still pay your debt in swelling-share money more ten years or even more.

Although not, just remember that , the fresh monthly installments do then getting higher than it was indeed before to the changing straight back, therefore wonder whether or not the quick-title respiration area you will get through transferring to attention-merely would make your financial issues bad in the end.

Some residents will get favor alternatively to give the mortgage term by six months an alternate area of the present agreement anywhere between banking institutions additionally the authorities. An expansion, even though, will mean you would certainly be paying significantly more interest across the term of your own financial.

If you choose to revert into early in the day cost bundle when this new six months was up, just be sure to imagine in which you becomes the excess funds from and work out within the financial shortfall at the bottom of the title. You may need deals positioned to achieve this.

When it saves your money would confidence the borrowed funds name you may have to start with.

Instance, say you have got a phrase regarding thirty five ages into the a cost mortgage and want to switch to focus-only your own monthly repayments would not slip by much. It is because at the beginning of the home loan, you have to pay a top ratio of great interest versus financial support. Towards the end of financial title, it’s the most other way doing. If for example the term was quicker ten years, such as for example you’ll encounter a far more noticeable difference in month-to-month costs.

So there are of several points to to consider when deciding. Here are a few questions to ask before you make a switch. It is also well worth talking with one another a mortgage broker along with your current financial, who happen to be in a position to especially give you advice in your selection:

- Are you presently into the really serious monetary issue and also you sick every of your possibilities to financially vulnerable houses?

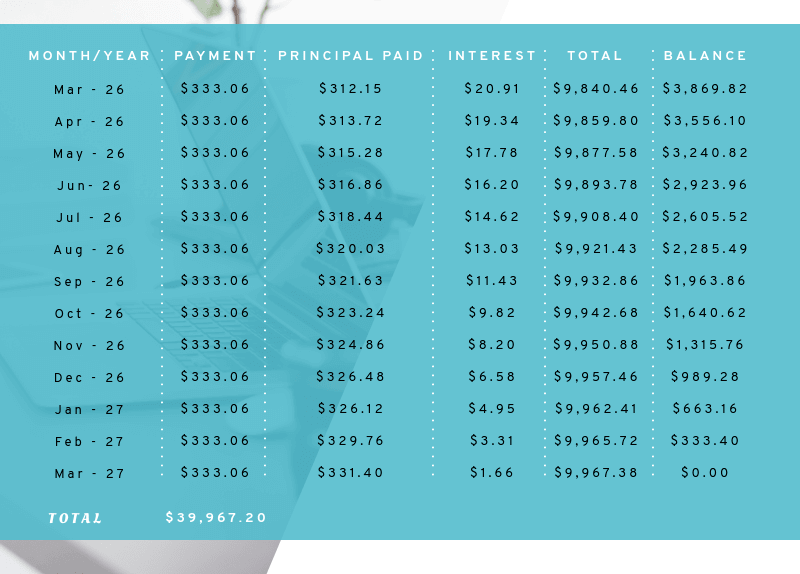

- Preciselywhat are their agreements at last brand new half dozen-week period is actually up? Remember: you are going to are obligated to pay more income more less time body type. Do you ever make typical overpayments an individual will be right back on your own base? Commonly the lender allow this? Extremely enable it to be ten% however, see the fine print on the deal. Do you really continue your own term? If you do, the degree of attract you pay full commonly go up thus have a tendency to this new payment break pay dividends? You can utilize the home loan calculator to assist exercise your coming repayments.

Important information

Some of the products advertised are from our user partners out-of which i discover settlement. Even as we seek to element the best activities available, we simply cannot review all the product in the market.