For those who have credit cards which can be charging twelve%+ in the desire and you’re only able to make minimal fee, this may be the right position where it’s a good idea when deciding to take financing from the 401(k) and you can payoff the credit notes. However,………however,…….this really is simply a good idea if you aren’t supposed to operate right up people bank card stability again. When you are in an exceedingly crappy financial situation and you also tends to be oriented to have bankruptcy, is in reality don’t to take currency out of your 401(k) because your 401(k) membership was protected against creditors.

Bridge A short-Term Cash Crunch

For individuals who find a short-name cash crunch the place you has a big bills although money wanted to protection the expense are postponed, a beneficial 401(k) mortgage ple is exchanging a home on top of that. If you like $31,000 on down payment in your brand new home and also you have been hoping to get that funds from new proceeds from the brand new sale of one’s current household although closure in your current home gets forced back of the 1 month, you might propose to capture a good $29,000 financing from your own 401(k), close to the new home, after which https://paydayloancolorado.net/cherry-creek/ use the proceeds from this new sale of your most recent family to payoff this new 401(k) financing.

Appear to, the largest challenge getting very first time homebuyers when planning to buy a house was picking out the dollars to meet up the newest down-payment. If you were causing your 401(k) as you already been performing, it is really not uncommon that the equilibrium on your own 401(k) bundle would-be your own biggest advantage. In case the correct possibility occurs to order a house, it may is reasonable to take an excellent 401(k) financing to bring about the brand new deposit, rather than waiting the other many years this carry out test build up an advance payment outside the 401(k) account.

Alerting using this type of alternative. Once you borrow funds out of your 401(k), their get hold of pay might possibly be smaller because of the level of brand new 401(k) loan money across the time of the loan, and after that you commonly a see the fresh mortgage repayment ahead of the when you personal for the brand new home. Creating a formal finances prior to so it choice is highly demanded.

Capital First off A business

We have had website subscribers that chose to get off the organization community and start her team but there’s constantly a period of time pit between after they been the company just in case the business actually begins earning money. Its hence that one of one’s top challenges having entrepreneurs is wanting to discover the funding to get the organization off the ground and also have dollars positive as soon as you can. As opposed to gonna a lender for a loan or increasing money from family and friends, if they got a beneficial 401(k) due to their former workplace, they’re able to to setup a solamente(K) plan using their brand new company, rollover the equilibrium within their new Unicamente(K) bundle, take good 401(k) financing using their the latest Solo(k) package, and employ you to definitely resource to operate the company and spend their personal expenses.

Once more, word of alerting, starting a business are risky, and therefore approach concerns spending money which was set aside getting new senior years years.

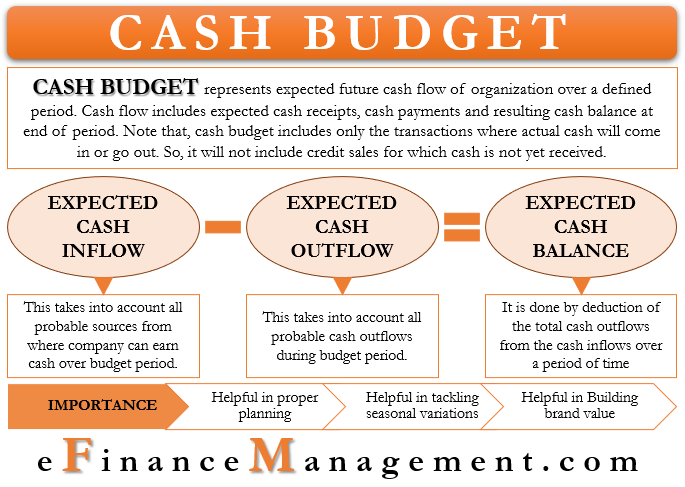

Your bank account Is beyond The market industry

When you take financing from the 401(k) account, those funds is removed to suit your 401(k) account, following slowly paid off over the time of the mortgage. The money that was lent out is no longer getting funding get back on your own advancing years membership. Even though you try repaying that amount throughout the years it will keeps a sizable influence on the balance which is on your account at old-age. How much? Let’s take a look at an excellent Steve & Sarah analogy: