Nathan enjoys trained English literary works, business, social sciences, writing, and background for over 5 years. He has a b.An effective. in the Comparative Reputation for Ideas throughout the College out of Washington.

Table off Information

- What exactly is a good Subprime Home loan?

- Focusing on how Subprime Lending Really works

- Examples of Subprime Mortgages and Individuals

- That which was this new Subprime Home loan Crisis?

- Lesson Summary

What’s an excellent Subprime Home loan?

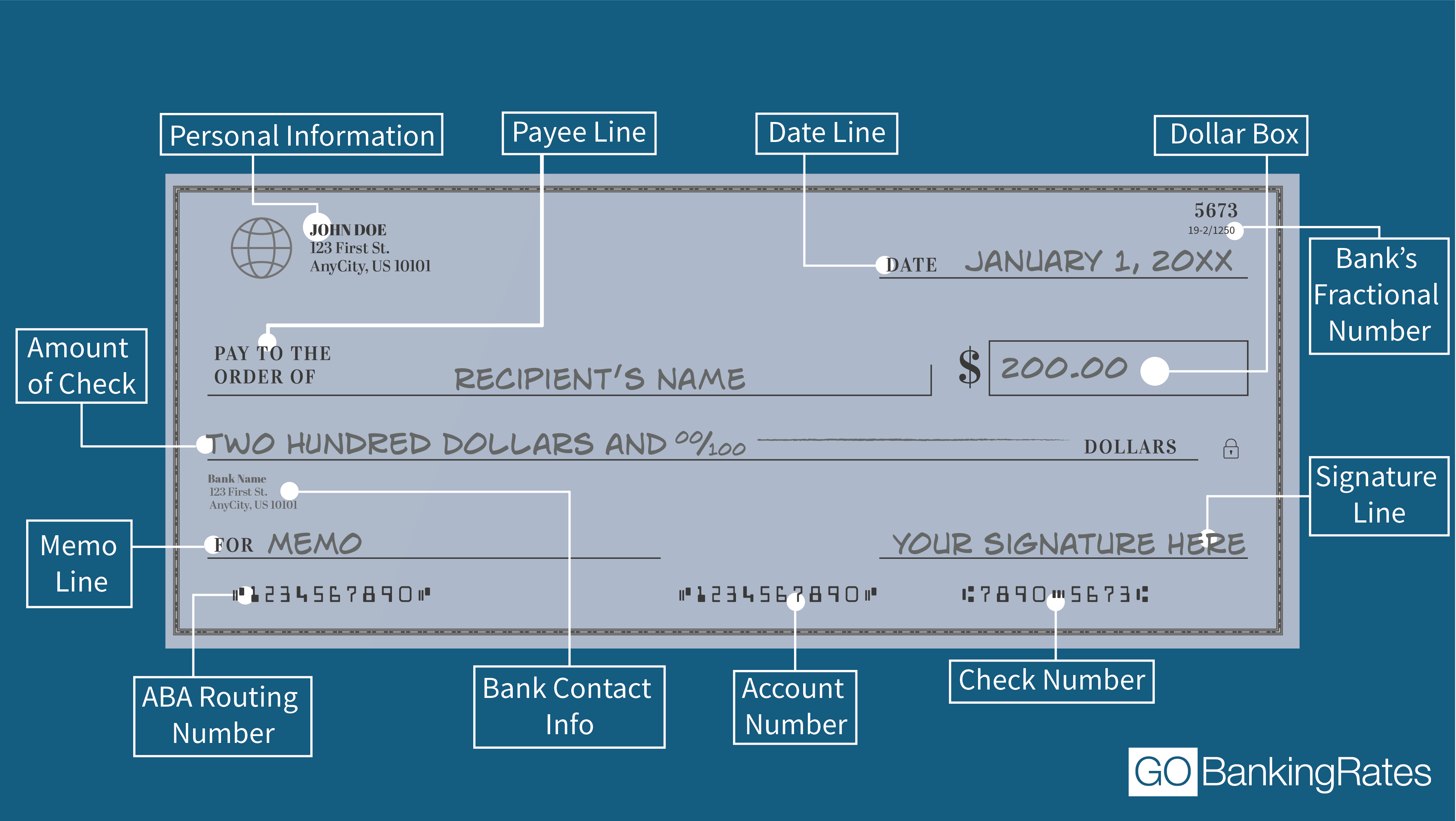

Home financing is a type of loan in which a borrower uses their a residential property since the guarantee. Whenever a guy takes out home financing, he’s essentially borrowing funds from the financial institution and using their house once the safety to the financing. The bank tend to retain the fresh action on possessions before the financing might have been paid back entirely. Mortgages is removed for various reasons, particularly to purchase a unique domestic otherwise making improvements so you’re able to a keen current that.

A great subprime mortgage is a type of mortgage that is offered to help you individuals which have less than perfect credit records. These types of mortgage loans routinely have highest rates and require large down payments than simply traditional mortgages. For the reason that the lending company thinks you will find a top exposure of the lending currency so you can individuals with poor credit. By greater risk, subprime mortgage loans may do have more strict criteria to have qualification. Individuals have to generally render proof earnings and you may a percentage background just before they can be recognized for a financial loan.

What’s a good Subprime Financing?

Just like an excellent subprime financial, a beneficial subprime mortgage is one that’s given to borrowers that have poor credit records. Rates of interest and requires to possess qualification are similar, if not more stringent, than others to have good subprime home loan. However, in place of having fun with a residential property since security, this type of subprime funds are unsecured and you will useful people mission. Thus a borrower can use the loan to order such things as chairs or automobiles, or even mix most other costs. The chance for the financial are high while there is zero security backing the mortgage, which means such loans will come which have higher still interest rates than subprime mortgage loans. Plus, borrowers which have bad credit may find it hard to feel approved to possess a great subprime loan from the greater risk on the lending to them.

- Lesson

- Test

- Course

Finding out how Subprime Lending Works

The first step of your subprime credit processes is the application stage. Individuals trying a beneficial subprime mortgage should provide the lender that have facts on the credit rating and you can money, along with any appropriate economic guidance. This article is then always assess the borrower’s creditworthiness.

The second step is the recognition process. If for example the debtor suits all of the lender’s requirements, they is recognized for the mortgage. The lending company will influence the loan matter and you will interest rate that are offered with the borrower.

The next action is the fees and you will contract process. Brand new debtor need certainly to agree to the newest terms and conditions of your mortgage to make costs on time according to arranged-abreast of plan. Inability to accomplish this may cause penalties and fees.

Finally, the newest step four is the cancellation processes. This requires this new borrower paying off the level of the mortgage from inside the complete, in addition to any appropriate desire and fees. Once the financing are paid back entirely, the lending company usually cancel brand new contract and you may return this new action or almost every other equity toward debtor.

Subprime against. Perfect Financial

The top rates is actually an interest rate put by the finance companies one serves as a standard for other credit rates. It is in line with the Government Money Speed, that is an increase place by Federal Set aside. The prime rate is actually a good sign out-of economy criteria that will be widely used since the baseline rate of interest for user financial loans. A prime mortgage is just one that observe the top rate and have fundamental criteria to own certification considering credit history and income. Usually, best mortgages keeps lower rates compared to subprime mortgage loans, require reduce costs, and now have high standards when it comes to credit score and you can earnings. Thus, finest mortgages are sensed a much better choice for individuals with good credit.

Having said that, subprime mortgages, as previously mentioned earlier, are focused to your individuals with less than perfect credit records. This type of financing always incorporate highest rates, additional software requirements, and you may larger down payments as compared to finest mortgage loans. Individuals taking out a great subprime home loan in addition to face large dangers by improved interest rates. When considering an effective subprime home loan, it’s important to weighing the risks and you may perks.

Particular Subprime Mortgages

There are lots of variety of subprime mortgage loans. These kinds vary in accordance with the borrower’s credit score, loan types of, and other circumstances. Around three well-known variety of subprime mortgages are variable-rates mortgage loans (ARMs), fixed-price mortgages, and you can appeal-just mortgage loans.

- Adjustable-Price Mortgages (ARMs): Fingers is mortgage loans you to start out with a predetermined-interest rate and in the end conform to site here a floating adjustable speed. The duration of the fixed-interest several months may differ with respect to the form of Sleeve. Like, a great step three/twenty seven Sleeve was a thirty-seasons financial with an initial fixed price towards first about three decades prior to typing an adjustment stage, when you’re a 2/twenty eight Arm is home financing with a first repaired speed off a couple of years in advance of entering a modifications phase. The floating rates is generally influenced by a combination of a beneficial specific directory, such as the London Interbank Offered Rate (LIBOR), and a good margin. Such mortgages usually include a lower initial appeal rate, that will improve throughout the years. For this reason, Arms are best fitted to consumers which expect to flow otherwise re-finance in a number of age.