When mortgage lenders and you can nurses join forces, the result is a collection out-of exclusive home loan sales you to is significantly lighten the newest economic load of shopping for a property. Nurses is also utilize offers due to apps such as for instance HEROs Homebuyer Software, that offer an excellent medley from has, rebates, and you can shorter costs tailored so you’re able to medical care pros. Normally, the brand new deals is also reach up to $3,000, a price which can generate a substantial variation when cost management getting a different house.

- Closing credit

- Removal of many costs at closure

- Straight down interest levels

- Smaller down costs

- So much more functional certification requirements you to mirror their top-notch balances and you may precision

Such strategies commonly just bonuses; these are typically an identification of one’s pivotal role nurses gamble within our groups. By integrating that have individual loan providers, nurses can also enjoy these types of gurus.

Navigating the loan surroundings given that a nursing assistant is introduce novel pressures, but with suitable methods, such hurdles would be transformed into stepping stones. Detailed a career documentation is vital, as well as handling money stability issues head-toward, especially for take a trip nurses who may go through changing income and employment patterns. Moreover, controlling student financial obligation is a must, that have software particularly Nursing assistant Corps Loan Payment offering to expend upwards so you can 85% from delinquent beginner loans, and therefore presenting a far more positive profile to help you loan providers.

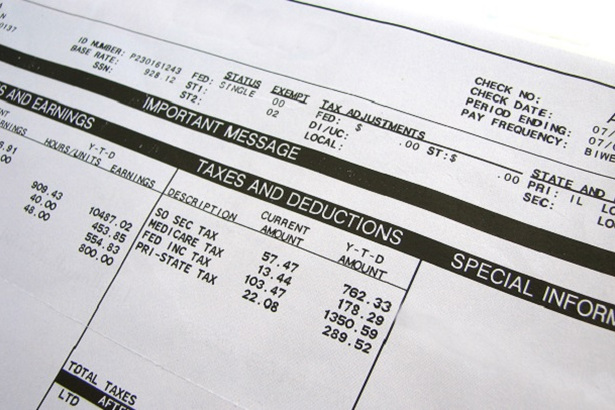

Earnings verification normally nuanced, that have non-taxable and you may for each diem pay demanding cautious records. Tax statements, shell out stubs, cash reserves, otherwise company letters verifying the possibilities of went on money can also be all the serve as proof monetary stability, bolstering an effective nurse’s mortgage qualification candidates. By the presenting a definite and you may full monetary photo, and their personal debt so you can money ratio, nurses is also efficiently browse the borrowed funds techniques, conquering obstacles confidently and you can clearness.

Selecting the most appropriate Home loan Road: Techniques for Nurses

Entering the trail to help you homeownership begins with selecting the mortgage one best aligns which have an individual’s financial and private factors. Having nurses, it means providing a close look at fico scores, comparing down-payment potential, and you americash loans Rogersville can because of the location of the wished property. Whenever you are Virtual assistant funds might not explicitly mandate a minimum credit rating, lenders generally speaking favor a score with a minimum of 620, demonstrating the significance of creditworthiness about choices techniques.

Calculating just how much family one can possibly afford ‘s the undertaking cut-off, ensuring that new selected financial suits within a reliable earnings record, a necessity common across extremely financial facts. Nurses should strategy that it e care and attention and you can diligence it implement when you look at the the occupation, consider all the what to select home financing that offers not only a home, however, a house you to nurtures better-being and you will stability.

Mortgage System Wisdom to possess Healthcare Workers

Medical care gurus, in addition to nurses, will find peace and quiet and you will service from inside the mortgage loan system possibilities created making use of their unique economic need and profession trajectories at heart. Character Homebuyer Programs streamline the brand new to order process, offering accessible and you will affordable routes so you can homeownership. Also, physician lenders serve individuals with high education loan loans and you may restricted deposit info, giving customized capital selection one to know the brand new higher earnings and requiring works times off medical professionals.

Apps such Homes to possess Heroes continue its advantageous assets to new wide healthcare society, coordinating gurus that have a house and mortgage professionals who see the book circumstances.

For these whoever monetary desires outstrip traditional constraints, specific physician mortgage programs render capital solutions that rise outside of the $step 3.5 billion s is when you need it.

Investment Your property: Tricks for Increasing Acceptance Chance

Securing a home loan are a great milestone home-to purchase excursion, and you can nurses can enhance the odds of approval because of the aiming for large credit scores, and therefore discover ideal home loan terms and conditions eg down interest rates and you can down repayments. Engaging with a cards fix pro are going to be a proper disperse, as it may end in improved fico scores you to definitely pave the treatment for advantageous loan conditions. Additionally, the average income getting entered nurses, updates at $89,000 per year, reveals an amount of financial stability that is certainly persuasive so you can lenders.