So you’re able to qualify for the fresh new limited exemption having unlock-end credit lines, a lender must have started, during the each of the a few preceding schedule ages, under five hundred open-stop lines of credit.

The limited exemption is not open to banks that don’t fulfill particular Society Reinvestment Act overall performance assessment rating standards.

To evaluate financial institutions’ conformity having HMDA standards, OCC test group usually work on understood secret studies areas throughout the transaction evaluation pursuant in order to HMDA to own data compiled to your otherwise immediately following ination professionals often concentrate on the 37 industries the following having banking institutions which can be subject to gathering, recording, and reporting suggestions for all HMDA analysis areas. Testing for banking companies you to be eligible for a partial exception away from HMDA investigation range, tape, and reporting conditions often manage 21 secret industries, due to the fact established less than, and validate that bank match this new standards to possess a limited exception to this rule. In some things, although not, and you can consistent with the FFIEC assistance, examination employees get influence that it’s compatible to review more HMDA studies areas.

Right revealing regarding HMDA data is essential in assessing the precision of one’s HMDA analysis one to creditors record and you may report. Where problems one to meet or exceed centered thresholds 10 is actually understood in the an enthusiastic institution’s HMDA analysis, the OCC supervisory work environment keeps discernment when you look at the requiring the college to help you best particular problems, in place of requiring resubmission of your data. The brand new supervisory work environment might need resubmission off HMDA analysis in the event that wrong data try an indicator away from systemic interior handle defects you to definitely label on the concern new integrity of your institution’s whole HMDA analysis report.

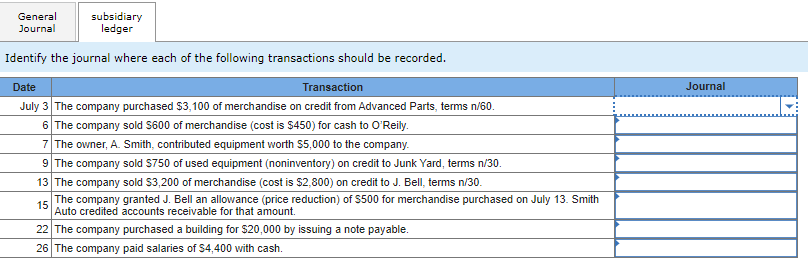

The following desk lists the primary study fields that examiners will use to guarantee the accuracy of the HMDA Mortgage/App Register (LAR) to possess finance companies that are full HMDA journalists and you may by themselves to own banking companies you to qualify for the fresh partial exclusion.

Conformity Statement

As established in to your an enthusiastic interagency base, this new OCC does not want to require investigation resubmission to possess HMDA research built-up when you look at the 2018 and you can said in 2019, unless study problems is topic. Additionally, the fresh OCC cannot plan to assess penalties with respect to mistakes for the analysis compiled in 2018 and you may reported into the 2019. Collection and you may submission of one’s 2018 HMDA studies deliver banking institutions which have a way to pick one holes in their utilization of the amended Control C while making advancements in their HMDA conformity government possibilities for future years. One assessments out of 2018 HMDA studies might be diagnostic, to assist banking institutions choose compliance defects, in addition to OCC tend to credit an excellent-trust compliance jobs.

Further information

six Starting with data amassed on otherwise immediately after , financial institutions subject to the new HMDA commonly collect and you may report studies on the secure loans given in a dozen CFR 1003.4(a)(1)-(38) on the a loan application register with which has 110 investigation fields, while the given from the FFIEC Submitting Information Guide (FIG). Reference FFIEC Info for HMDA Filers for more information.

eight The newest FFIEC players could be the FRB, FDIC, the new OCC, the fresh CFPB, the newest National Credit Commitment Government, plus the State Liaison Committee. The brand new FFIEC participants offer compliance which have federal user protection regulations and you may laws owing to supervisory and you may outreach applications. This new HMDA is regarded as such statutes.

8 OCC-controlled banks in addition to their subsidiaries must declaration things about denial on HMDA Mortgage/App Sign in (LAR) no matter partial difference reputation. Refer to 12 CFR twenty seven (national banking institutions) and you may a dozen CFR 128.6 (government savings connectivity).

ten Every piece of information offered inside bulletin medicine information approved towards the -31, “FFIEC HMDA Checker Purchase Assessment Guidance,” which means examiners will be head a financial to improve one study community with its complete HMDA LAR for your occupation where mistake rate is higher than the new stated resubmission tolerance. OCC examiners tend to consult with their supervisory office and, while the relevant, OCC’s Conformity Oversight Administration Division to determine if or not resubmission is required according to specific issues and you may items.

So you’re able to be eligible for the brand new partial exemption to have closed-avoid mortgages, a financial must have began, in the each of the a few before schedule many years, fewer than five-hundred closed-end banks in Texas that do personal loans with bas credit mortgages.