Technology-focused on the cardiovascular system of a credit partnership is how Jennifer Lopez Kouchis, SVP, Real estate Lending at VyStar Borrowing Relationship, describes the us-based borrowing from the bank connection, and this boasts a refreshing military history and you will a robust dedication to serving participants out of all the backgrounds that have imaginative products

Its a no more-for-profit, financial cooperative owned by its people and you may influenced by a volunteer Board out-of Directors and has now over more than $US12b inside the possessions.

The focus of VyStar is always to combine an educated advantages of credit unions customised services, lowest charge, higher cost and best-in-group activities with a partnership so you’re able to offering back into the fresh teams they provides. This will make interested in reasonable, quality financial products and properties an actuality due to their people.

VyStar Borrowing from the bank Union was looking at new push to have creative tech so you can enhance the consumer feel with respect to a home lending and it is providing creative fintech start-up’s for its users

For the past 2 years, VyStar Credit Relationship might have been expenses vast amounts in reducing-boundary fintech enterprises, both on its own and much more recently as an element of a good consortium out-of borrowing unions that has allowed brand new organization so you can move away technology that will work for their participants.

VyStar’s individual tech-oriented startup loans already been within All of us$10m inside the and it has grown so you can regarding the $50m, said Joel Swanson, VyStar’s Captain User Feel Administrator. The financing partnership belongs to the new Curql Collective, a coalition of nearly fifty credit unions nationwide one raised over United states$70 million from the earliest bullet out-of loans and is to your way to raise over Us$2 hundred million.

VyStar thinks the basis of profits for economic properties groups try grounded on their ability to keep imaginative. That guarantees the latest organisation preserves a competitive boundary, stays attractive to own people and you can possible people and you can has prior to the pace which have sector criterion. VyStar notices opportunities in fintech people because the chances to disperse the new organisation pass in support of its people.

VyStar try founded from inside the 1952 due to the fact Jax Navy Federal Borrowing from the bank Relationship on Naval Air Station Jacksonville. The target would be to serve the brand new monetary requires of army solution players, civil service employees, as well as their families. Ever since then he’s adapted to changes in this new banking world, out-of following its first computerised accounting system for the 1966 in order to beginning its very first Automatic teller machine within the 1982.

Inside 2002, they altered title so you can VyStar Borrowing from the bank Relationship and prolonged their world of registration so you can low-armed forces users. Today, the financing relationship has started to become one of the primary borrowing from the bank unions in america, offering more 780,000 players. VyStar are an associate-had and user-addressed financial cooperative.

We believe it’s important to echo the fresh groups we suffice. Meaning having a staff that knows them and giving circumstances and you may characteristics that really work to them so when all of our membership evolves it is important that we progress together as well as their standards, told you Kouchis talking using their head office in Jacksonville, Florida.

Electronic transformation features assisted VyStar focus on rates, personalisation, and you will comfort for the users. Electronic conversion process allows us to streamline techniques and you can get efficiencies by the getting documentation and investigation immediately upwards-front, getting convenience and you loans Aurora CO may simplification into the processes because of the leverage technology through the the loan travel, told you Kouchis.

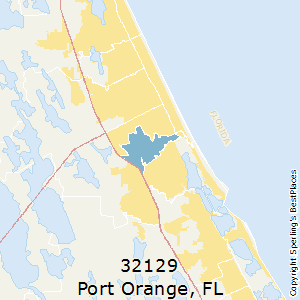

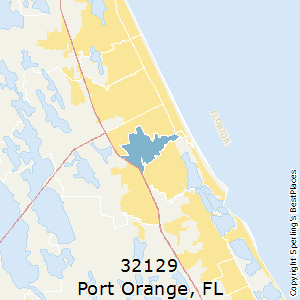

Because the largest mortgage lender within the Northeast Fl, VyStar Credit Relationship has an increasing arena of membership that’s available to a wide range of Fl and you will Georgia owners, plus past and give army professionals and their parents in the world

Subsequently we were in a position to obtain speed, render smaller decisions and intimate mortgages quicker in order to maintain that have consult and you can market expectations. Members get underwritten approvals much faster, eliminating fury with a lot of fall out and waits late along the way.